Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

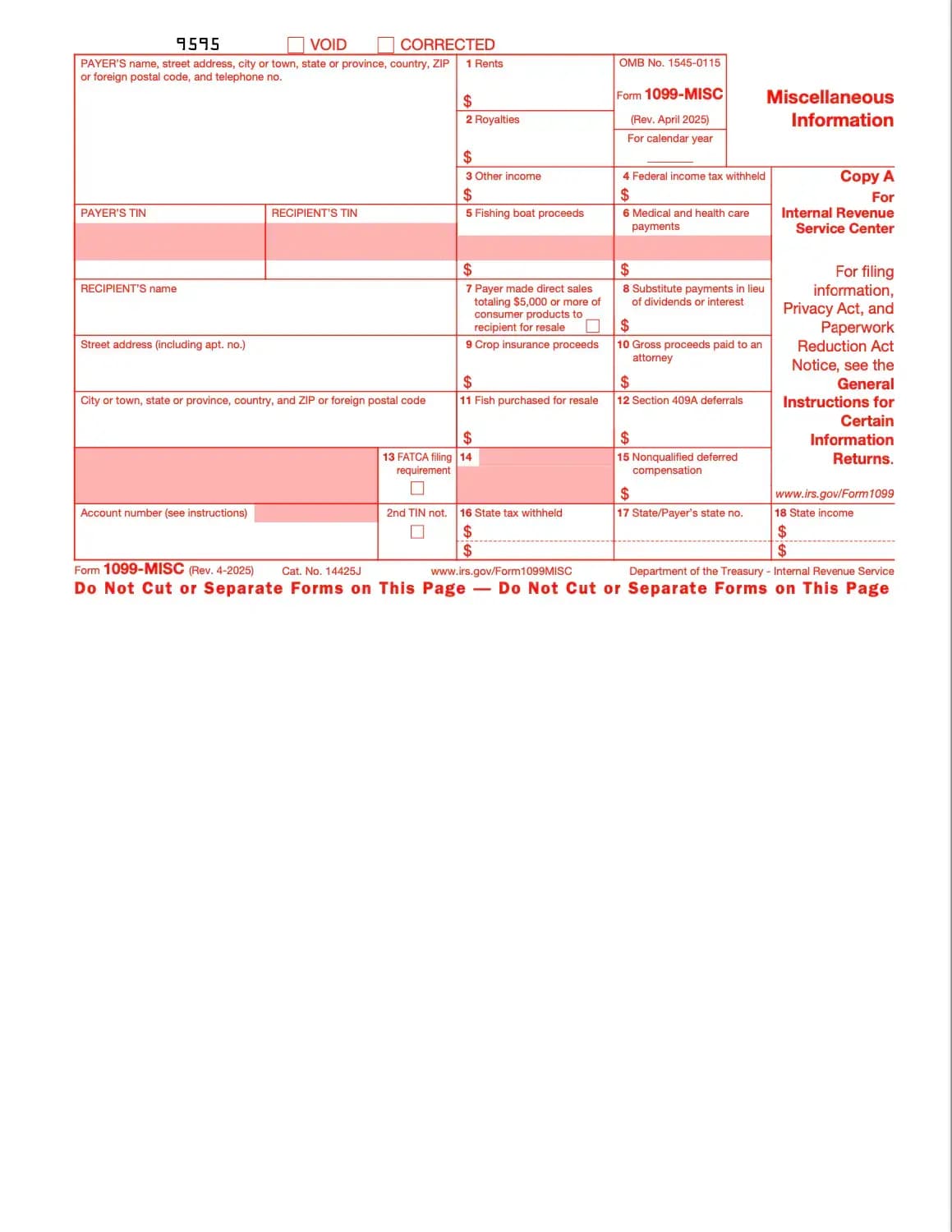

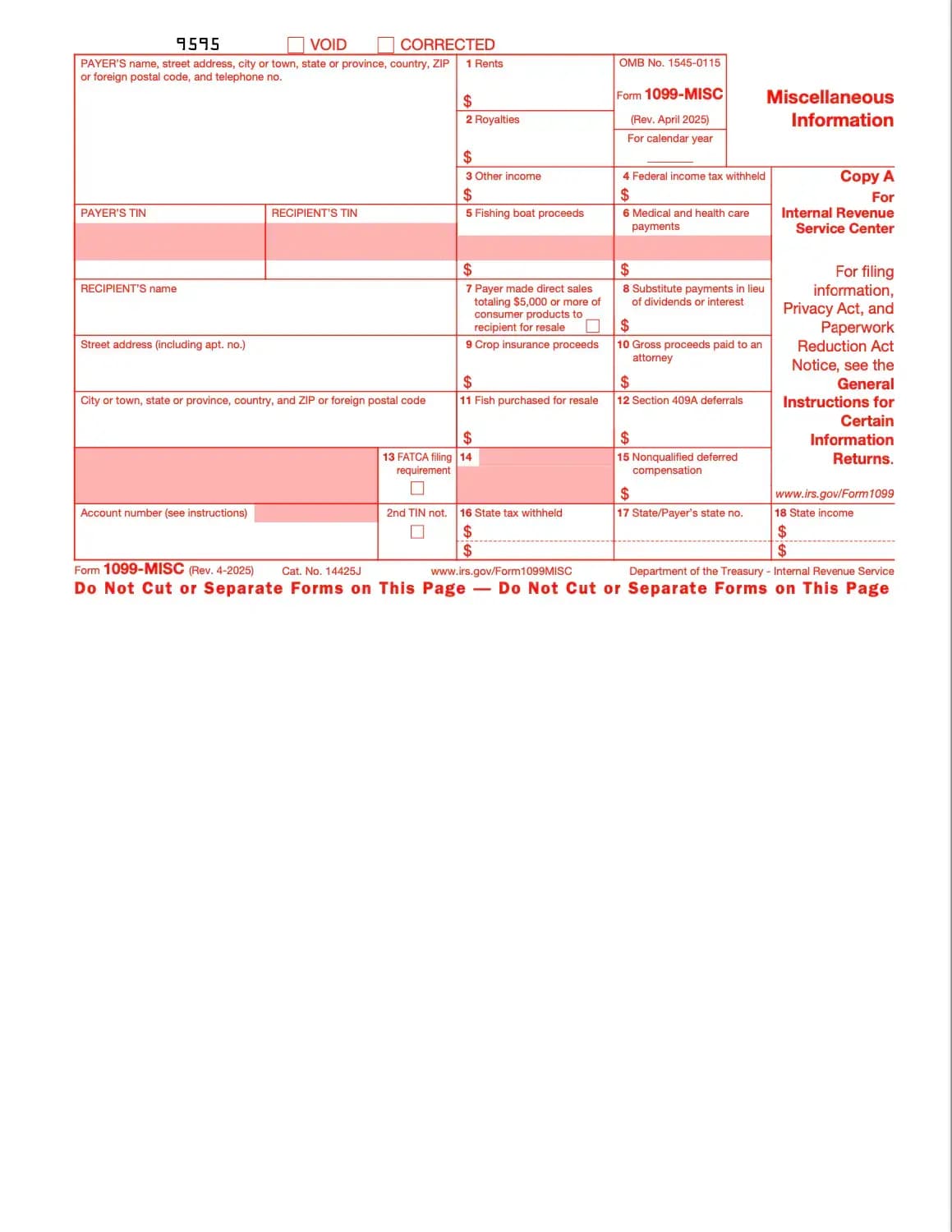

What is Form 1099-MISC?

The IRS 1099-MISC form is used to report miscellaneous income that doesn’t fall under regular wages or self-employment pay. It covers rent payments, royalties, prizes, awards, medical and healthcare payments, and other income categories.

Why is it important?

The IRS requires accurate reporting of all income. Recipients of 1099-MISC must include the amounts on their tax returns. Failing to report this income can result in penalties and interest.

Who must file Form 1099-MISC?

Businesses or individuals who paid:

What’s the difference between 1099-MISC and 1099-NEC?

What information is included?

When is it due?

よくある質問

1. フォームに記入

詳細と情報を記入し、日付を追加し、必要に応じてカスタマイズしてください

2. 署名を追加

描画、アップロード、または入力により法的拘束力のある署名を追加

3. ダウンロードまたは共有

フォームの準備完了、ダウンロード、リンク共有、またはメールで即座に送信