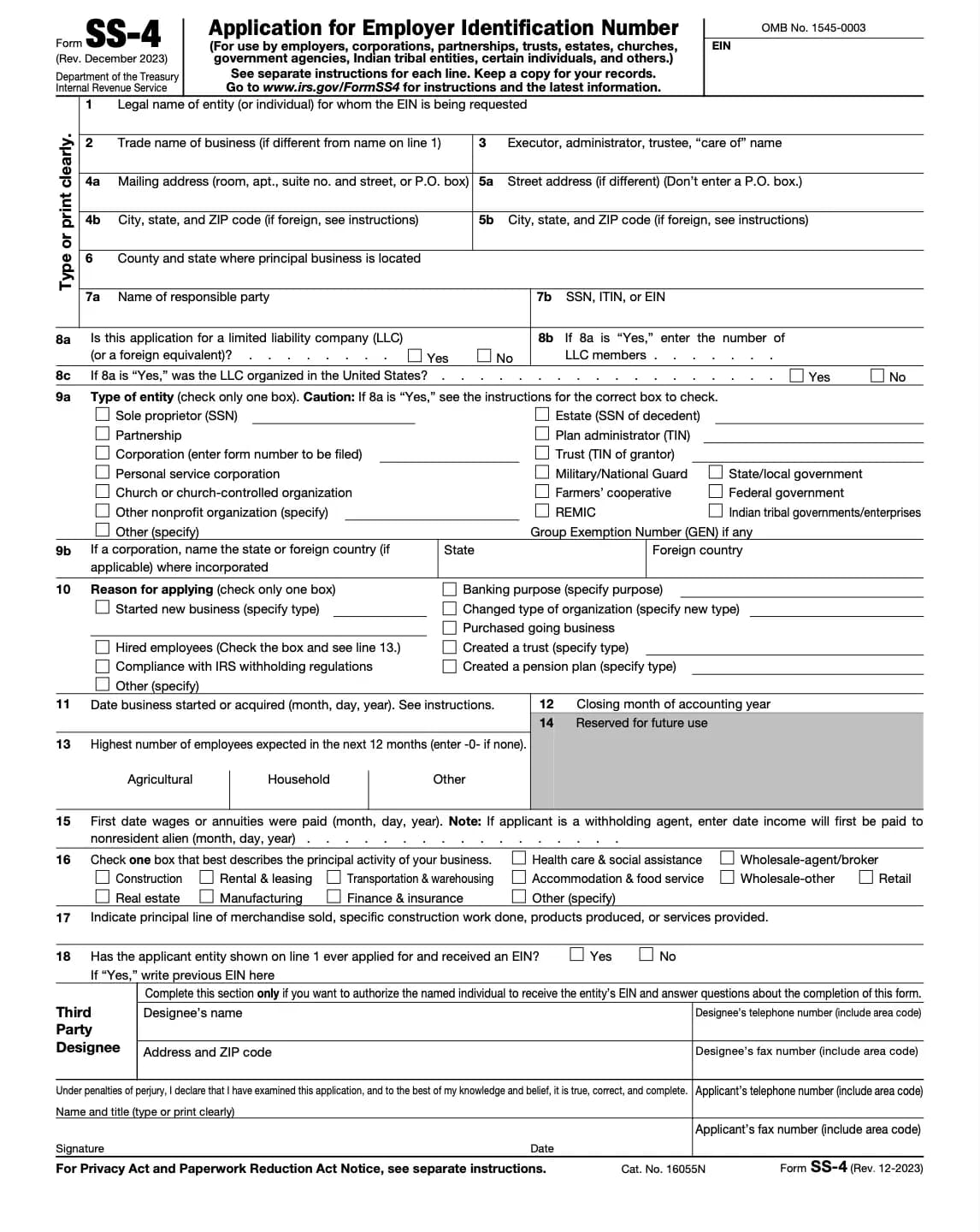

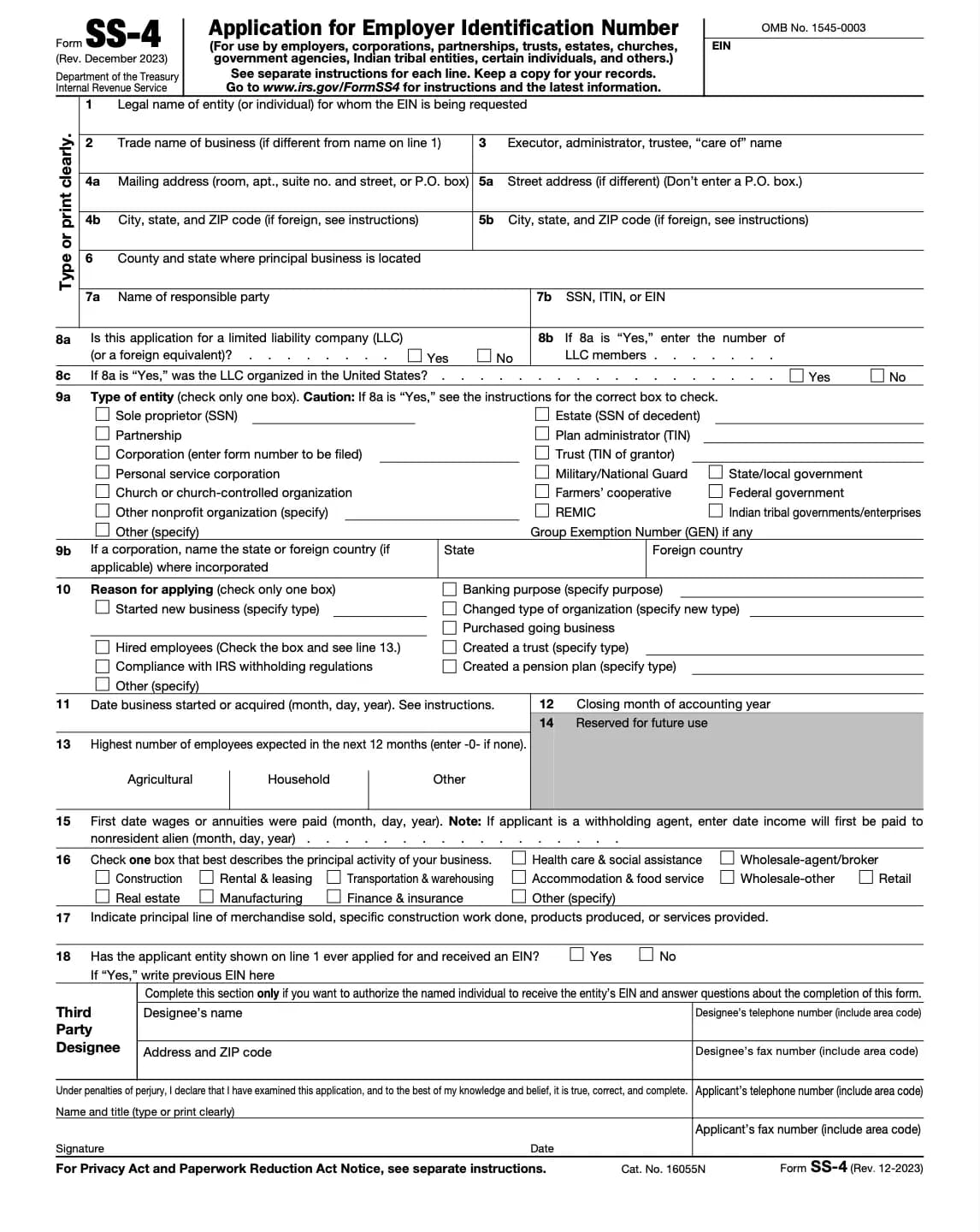

Everything You Need to Know About IRS Form SS-4

What is Form SS-4?

Form SS-4 is the official IRS application form used to request an Employer Identification Number (EIN). The SS4 form 2025 version reflects the most current updates and requirements for applying for your EIN in tax year 2025. This unique nine-digit number acts as a federal tax identification number for businesses, trusts, estates, and other entities.

You will need to complete the accurate SS4 document to ensure your application meets IRS standards, whether submitting online, by fax, or mail. The SS4 document outlines all the required details such as entity type, responsible party information, and reason for EIN request.

Who needs an EIN (via SS-4 form)?

Not every taxpayer needs an EIN, but many do. You must file Form SS-4 if you:

- Operate a corporation, partnership, or multi-member LLC.

- Hire employees and must file payroll taxes.

- Run a nonprofit, trust, estate, or pension plan.

- File excise taxes (alcohol, tobacco, firearms, fuel, etc.).

Act as a withholding agent for nonresident aliens. - Need to establish business credit or a separate bank account under a business name.

- Even sole proprietors may apply for an EIN to keep their SSN private and separate personal vs. business finances.

Why is an EIN important?

- Acts as your business identity number for the IRS and banks.

- Required to process federal employment and business taxes.

- Used when applying for business loans, credit lines, or licenses.

- Ensures compliance with IRS regulations.

- Protects owners from using their SSN on business documents, lowering identity theft risks.

Submission methods

- Online: Fastest; EIN issued immediately (available to U.S.-based applicants).

- Fax: 4 business days (confirmation sent back).

- Mail: Up to 4 weeks.

- Phone: For international applicants only.

Validity & Maintenance

- EINs never expire and are tied permanently to the entity.

- If business ownership or structure changes (e.g., sole proprietor converts to a corporation), a new EIN may be required.

- The IRS maintains EIN assignments in its Centralized Authorization File (CAF).

Common mistakes to avoid

- Using SSN instead of applying for an EIN when required.

- Applying for multiple EINs unnecessarily.

- Selecting the wrong entity type (leads to wrong tax obligations).

- Forgetting to include responsible party details.