Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

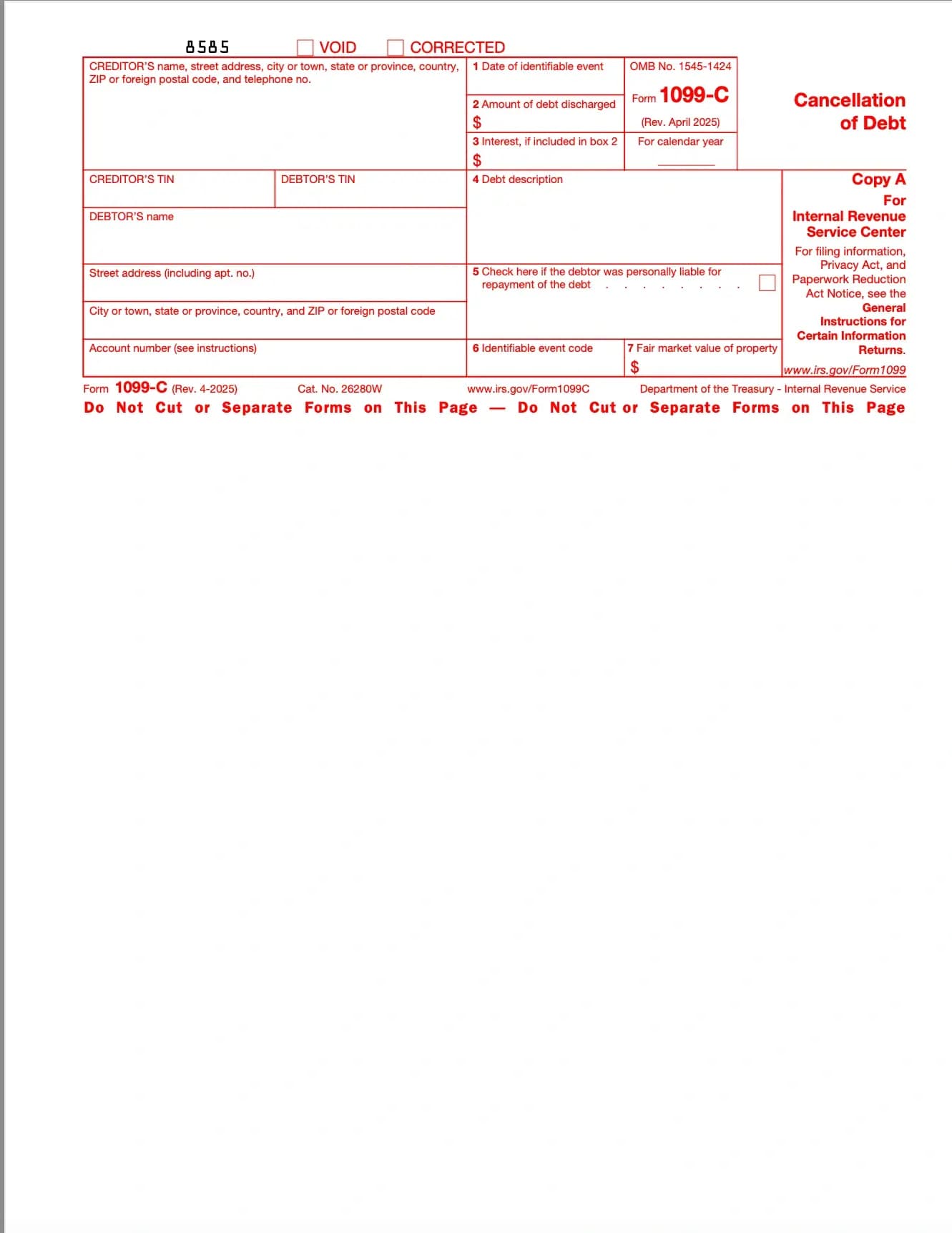

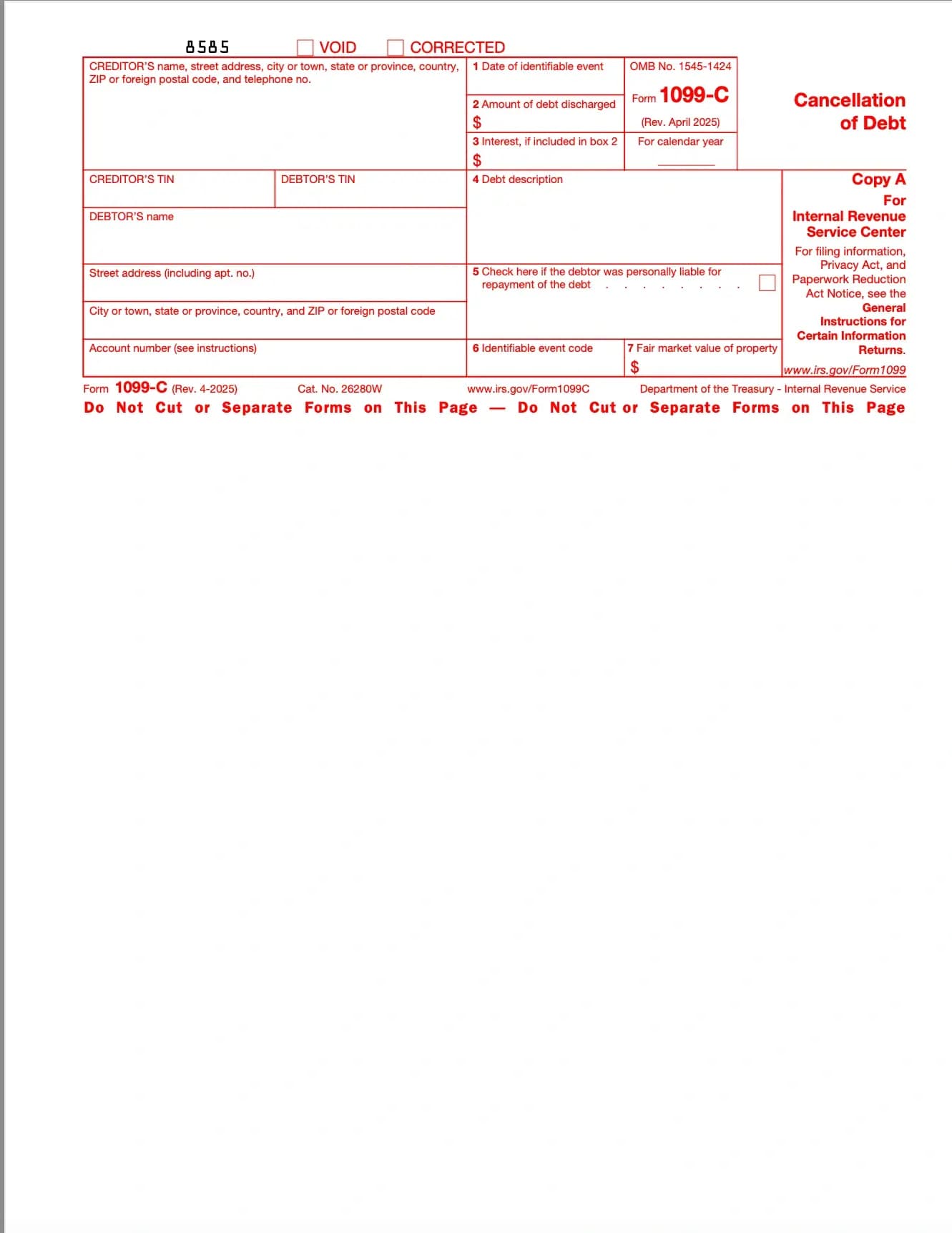

What is Form 1099-C?

Form 1099-C is an IRS information return used to report canceled or forgiven debt, typically when a lender forgives $600 or more of what you owe.

Who Should File Form 1099-C?

When Do You Receive Form 1099-C?

Borrowers typically receive Form 1099-C by January 31 of the year following the cancellation. The same information is also sent to the IRS.

Key Information Reported

Why is Form 1099-C Important?

How to Handle Form 1099-C

Processing Notes

Taxpayers who qualify for exclusions (like insolvency) must also file IRS Form 982 to claim the exception.

Veelgestelde vragen

1. Vul het formulier in

Vul uw gegevens en informatie in, voeg datum toe en pas aan zoals nodig

2. Voeg uw handtekening toe

Voeg juridisch bindende handtekening toe door te tekenen, uploaden of typen

3. Download of deel

Uw formulier is klaar, download, deel link of verstuur via e-mail direct