Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

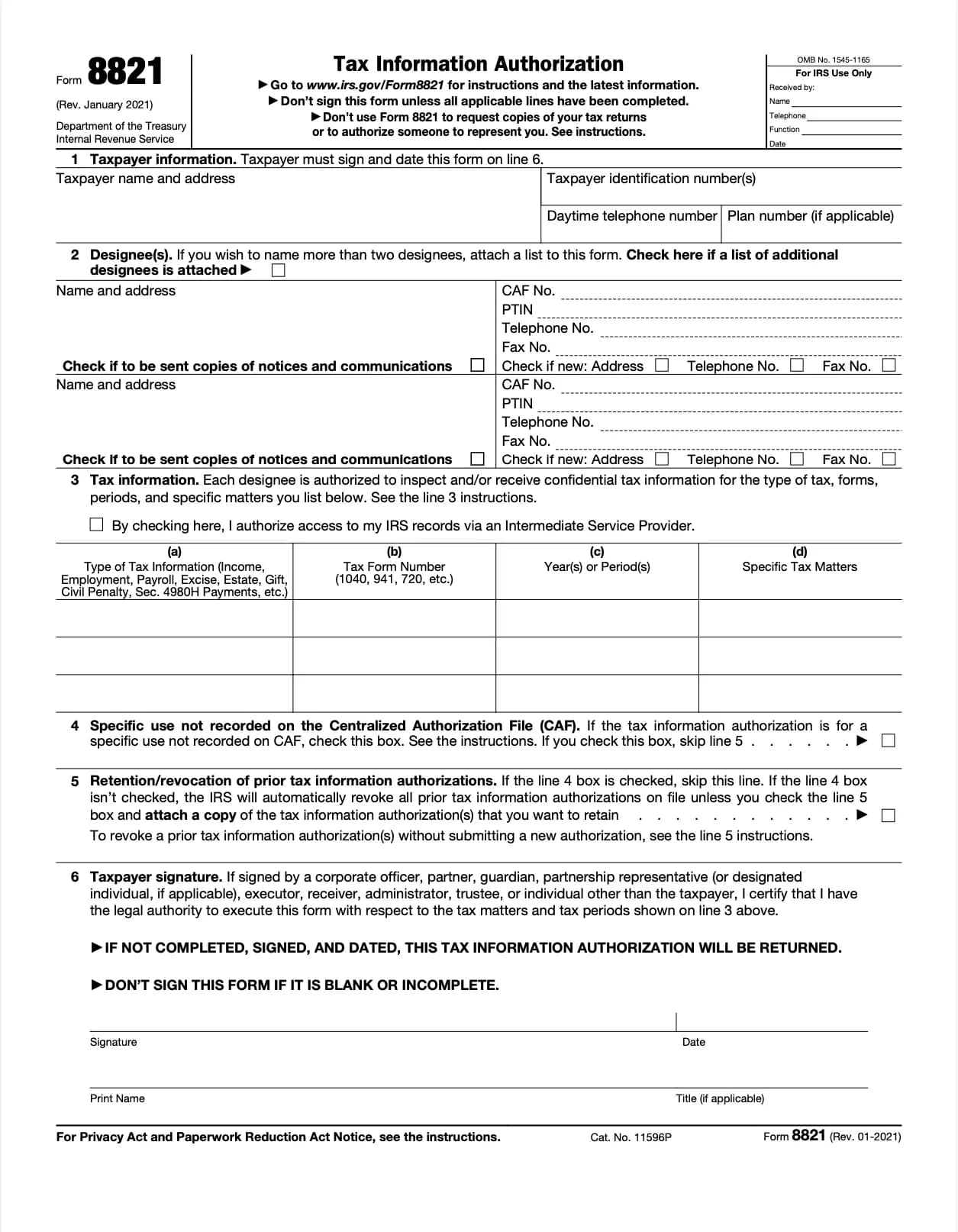

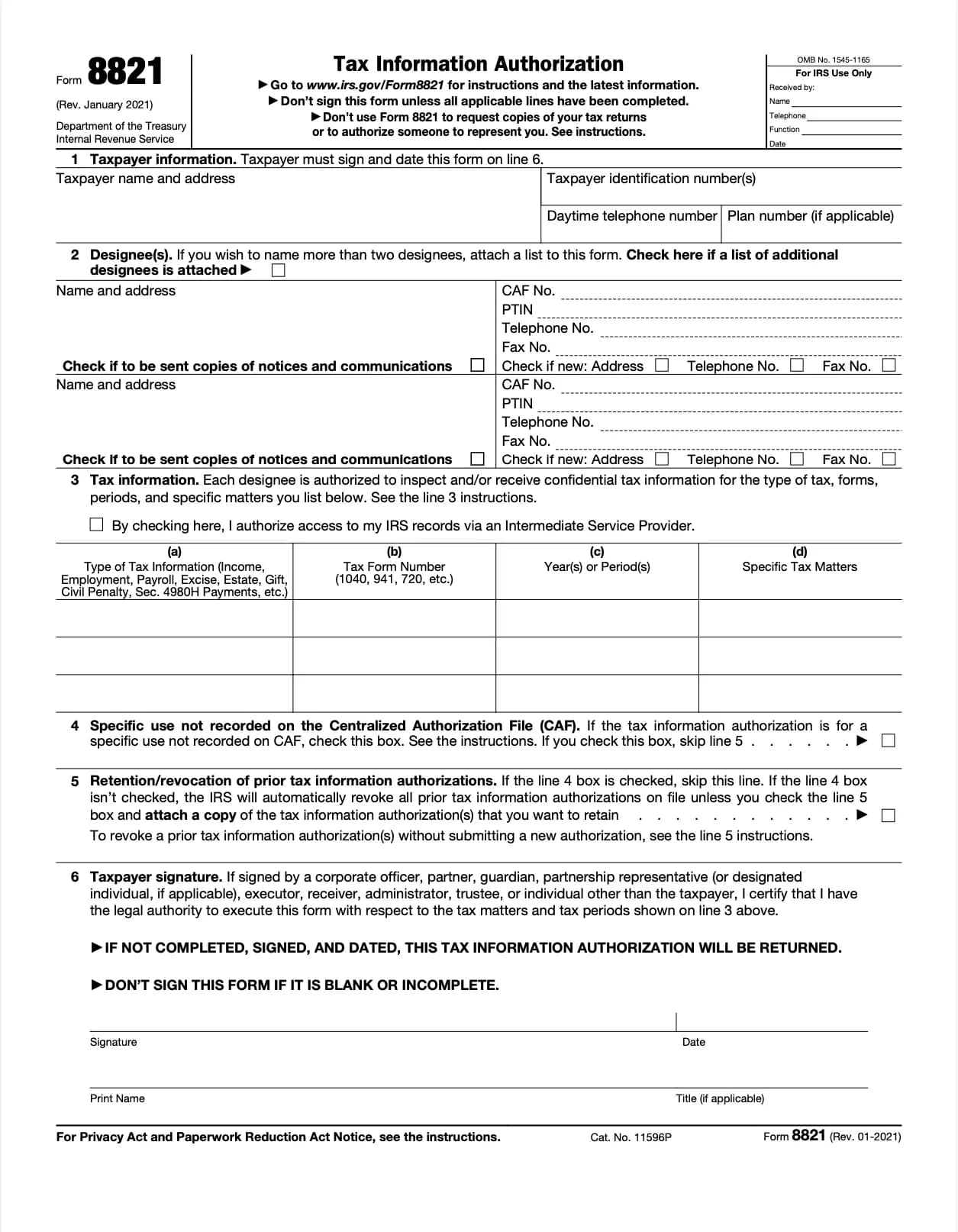

Form 8821, officially known as the Tax Information Authorization, allows you to grant permission for a third party,such as an accountant, tax advisor, or business representative,to access and review your IRS tax information. The authorized individual or organization can receive IRS notices, obtain copies of tax records, and communicate directly with the IRS about the specified tax years or issues.

Once submitted, the IRS typically processes Form 8821 within 5-10 business days, after which the authorized party can access your designated tax records.

Veelgestelde vragen

1. Vul het formulier in

Vul uw gegevens en informatie in, voeg datum toe en pas aan zoals nodig

2. Voeg uw handtekening toe

Voeg juridisch bindende handtekening toe door te tekenen, uploaden of typen

3. Download of deel

Uw formulier is klaar, download, deel link of verstuur via e-mail direct