Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

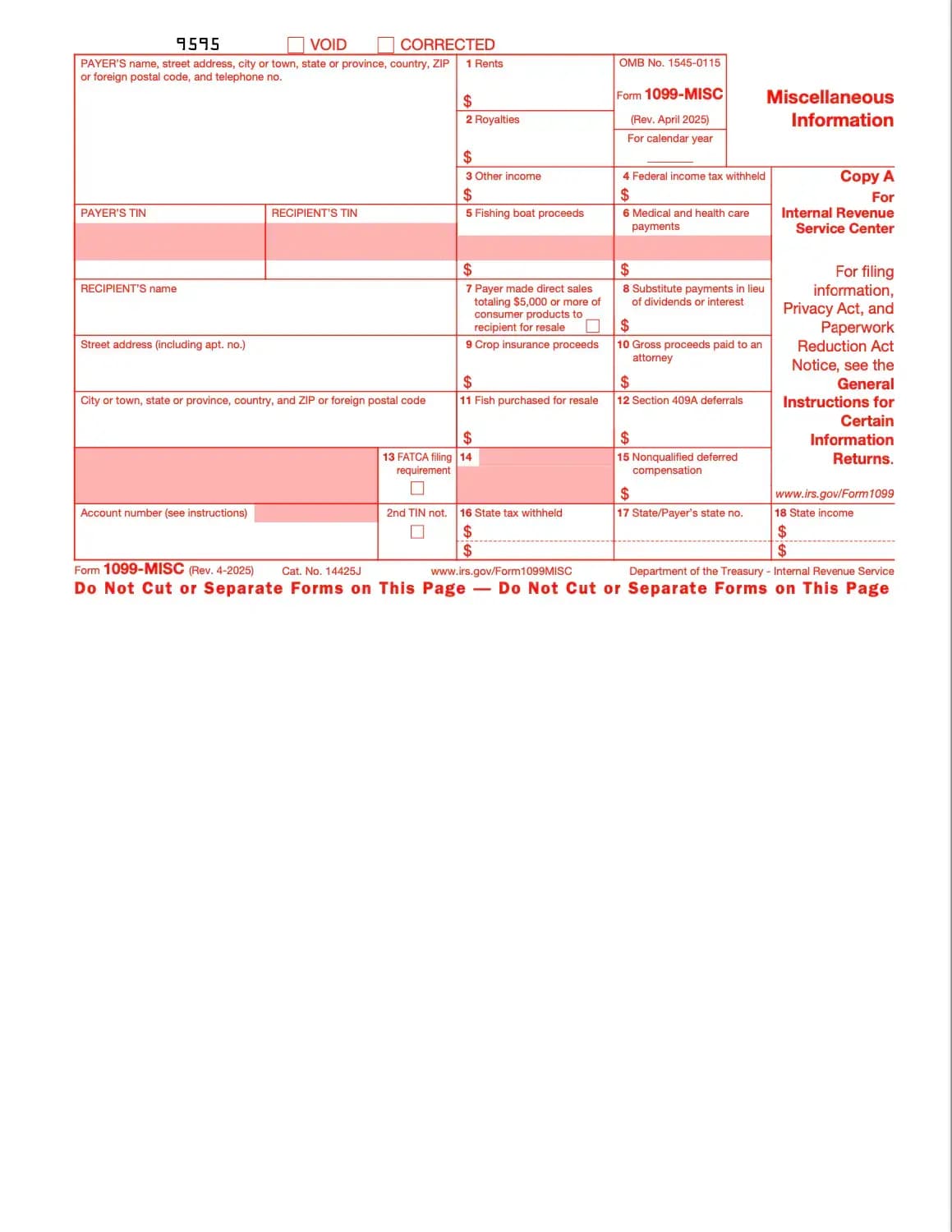

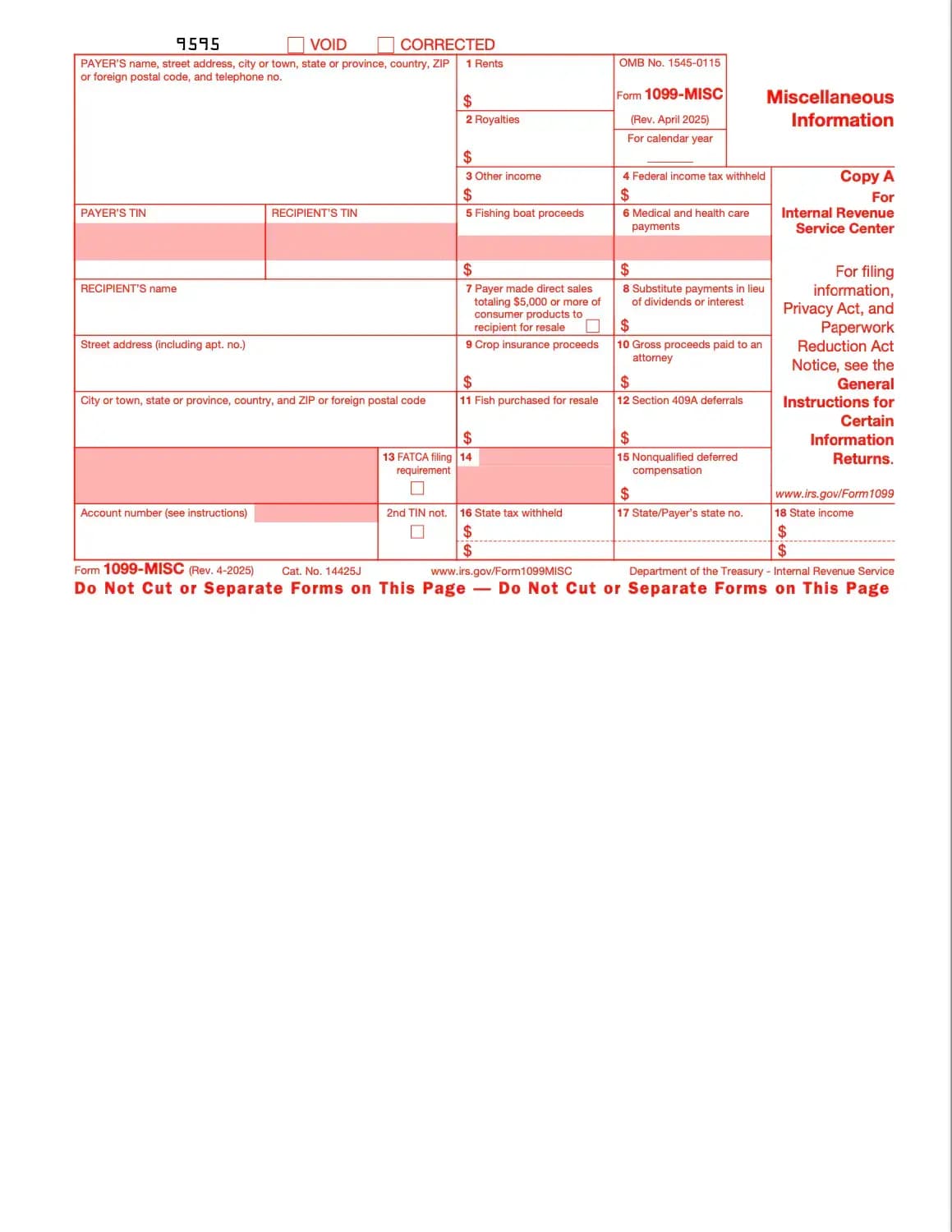

What is Form 1099-MISC?

The IRS 1099-MISC form is used to report miscellaneous income that doesn’t fall under regular wages or self-employment pay. It covers rent payments, royalties, prizes, awards, medical and healthcare payments, and other income categories.

Why is it important?

The IRS requires accurate reporting of all income. Recipients of 1099-MISC must include the amounts on their tax returns. Failing to report this income can result in penalties and interest.

Who must file Form 1099-MISC?

Businesses or individuals who paid:

What’s the difference between 1099-MISC and 1099-NEC?

What information is included?

When is it due?

Pogosto zastavljena vprašanja

1. Izpolnite obrazec

Vnesite svoje podatke in informacije, dodajte datum in prilagodite po potrebi

2. Dodajte svoj podpis

Dodajte pravno veljavni podpis z risanjem, nalaganjem ali tipkanjem

3. Prenesite ali delite

Vaš obrazec je pripravljen, prenesite, delite povezavo ali pošljite po e-pošti takoj