Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

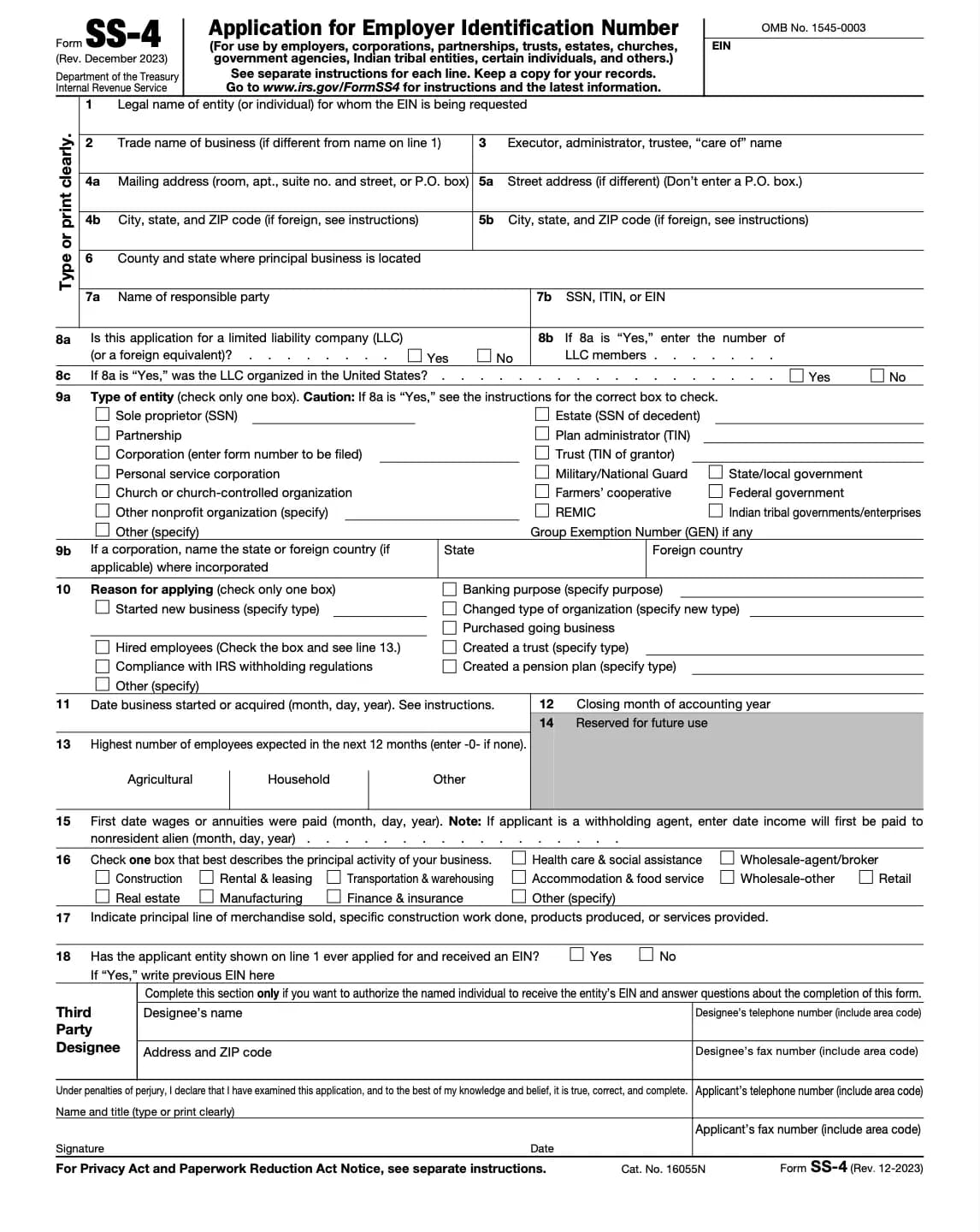

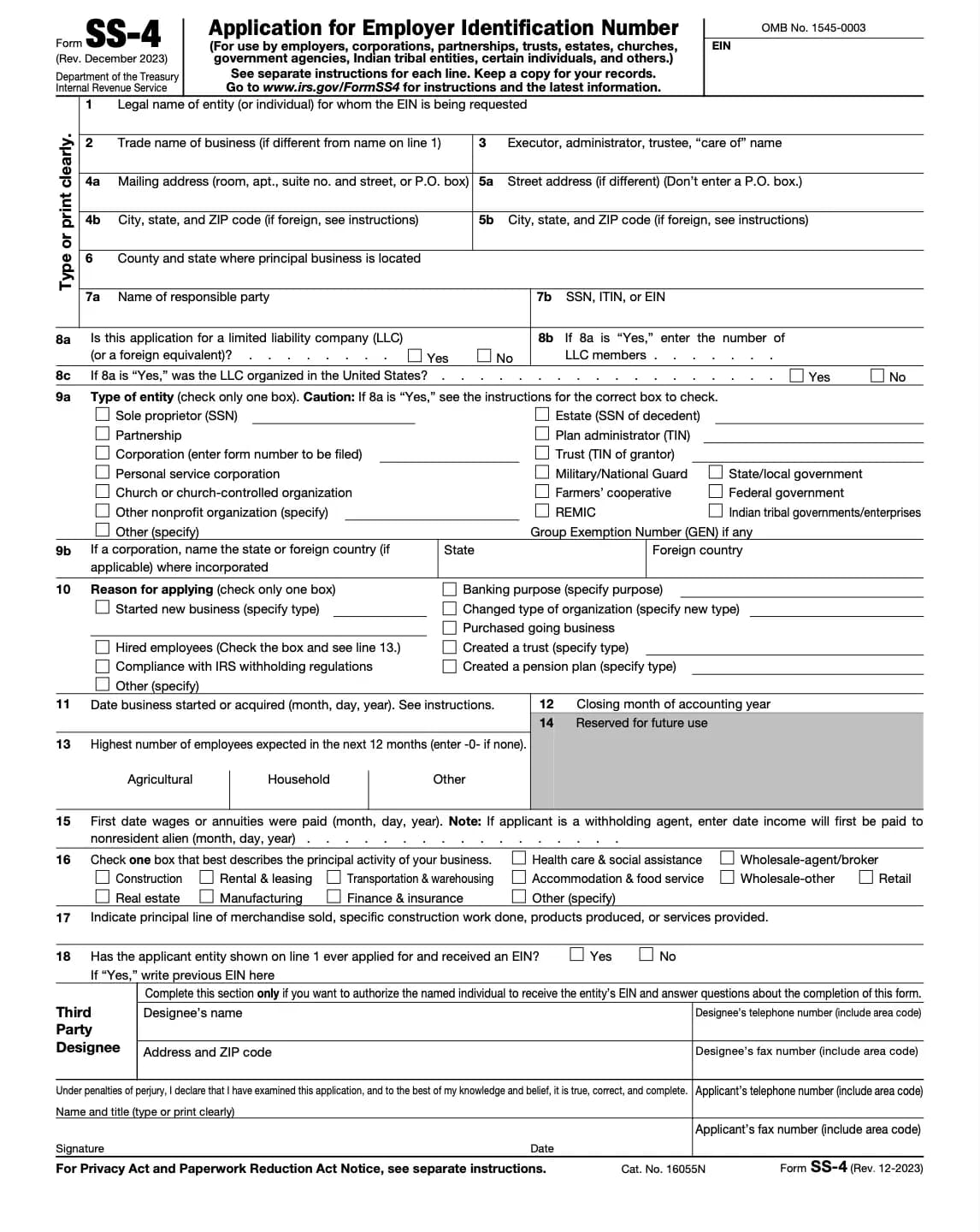

What is Form SS-4?

Form SS-4 is the official IRS application form used to request an Employer Identification Number (EIN). The SS4 form 2025 version reflects the most current updates and requirements for applying for your EIN in tax year 2025. This unique nine-digit number acts as a federal tax identification number for businesses, trusts, estates, and other entities.

You will need to complete the accurate SS4 document to ensure your application meets IRS standards, whether submitting online, by fax, or mail. The SS4 document outlines all the required details such as entity type, responsible party information, and reason for EIN request.

Who needs an EIN (via SS-4 form)?

Not every taxpayer needs an EIN, but many do. You must file Form SS-4 if you:

Why is an EIN important?

Submission methods

Validity & Maintenance

Common mistakes to avoid

Често задавани въпроси

1. Попълни формуляра

Попълни твоите данни и информация, добави дата и персонализирай според нуждите

2. Добави твоя подпис

Добави правно обвързващ подпис чрез рисуване, качване или въвеждане

3. Изтегли или сподели

Твоят формуляр е готов, изтегли, сподели връзка или изпрати по имейл незабавно