Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

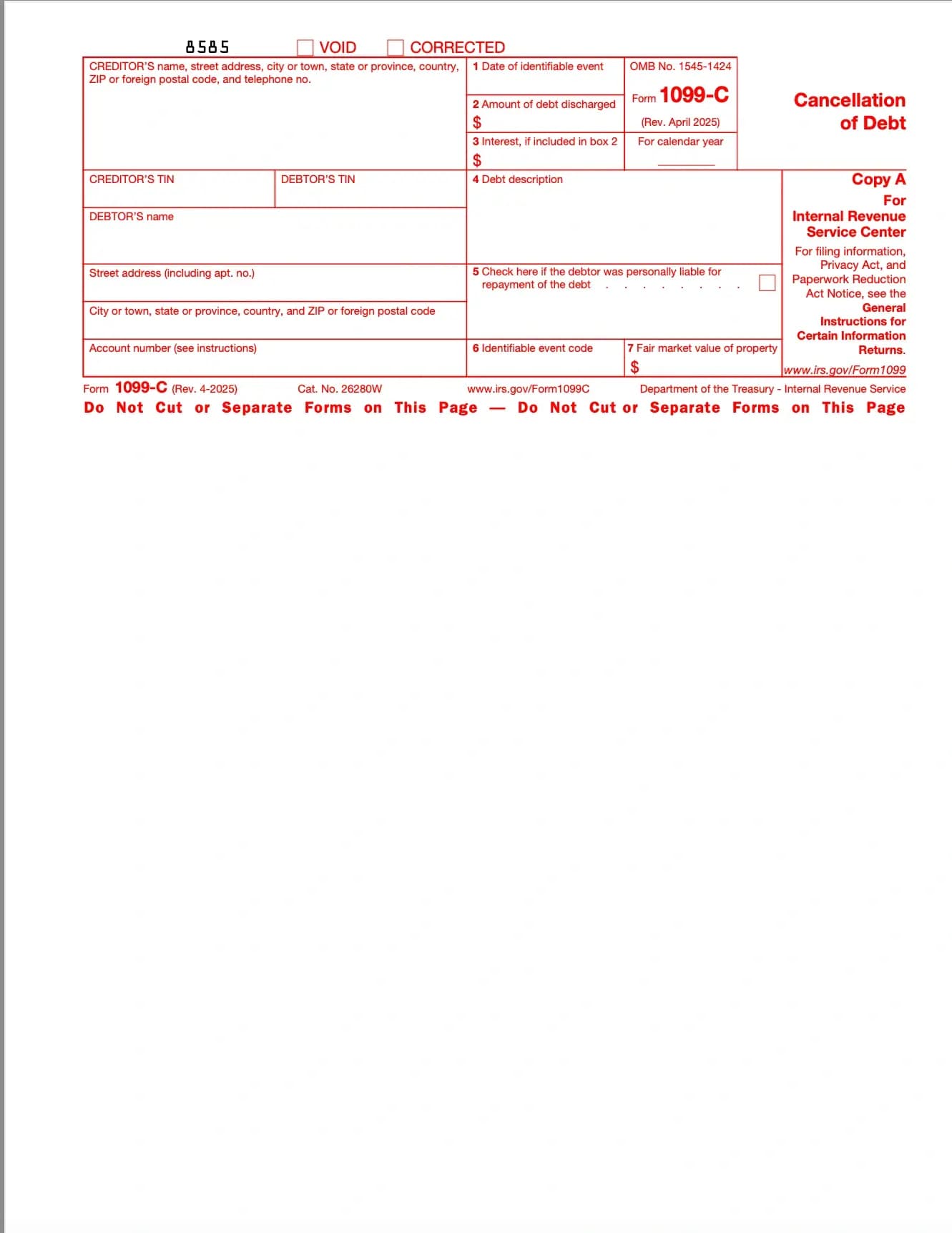

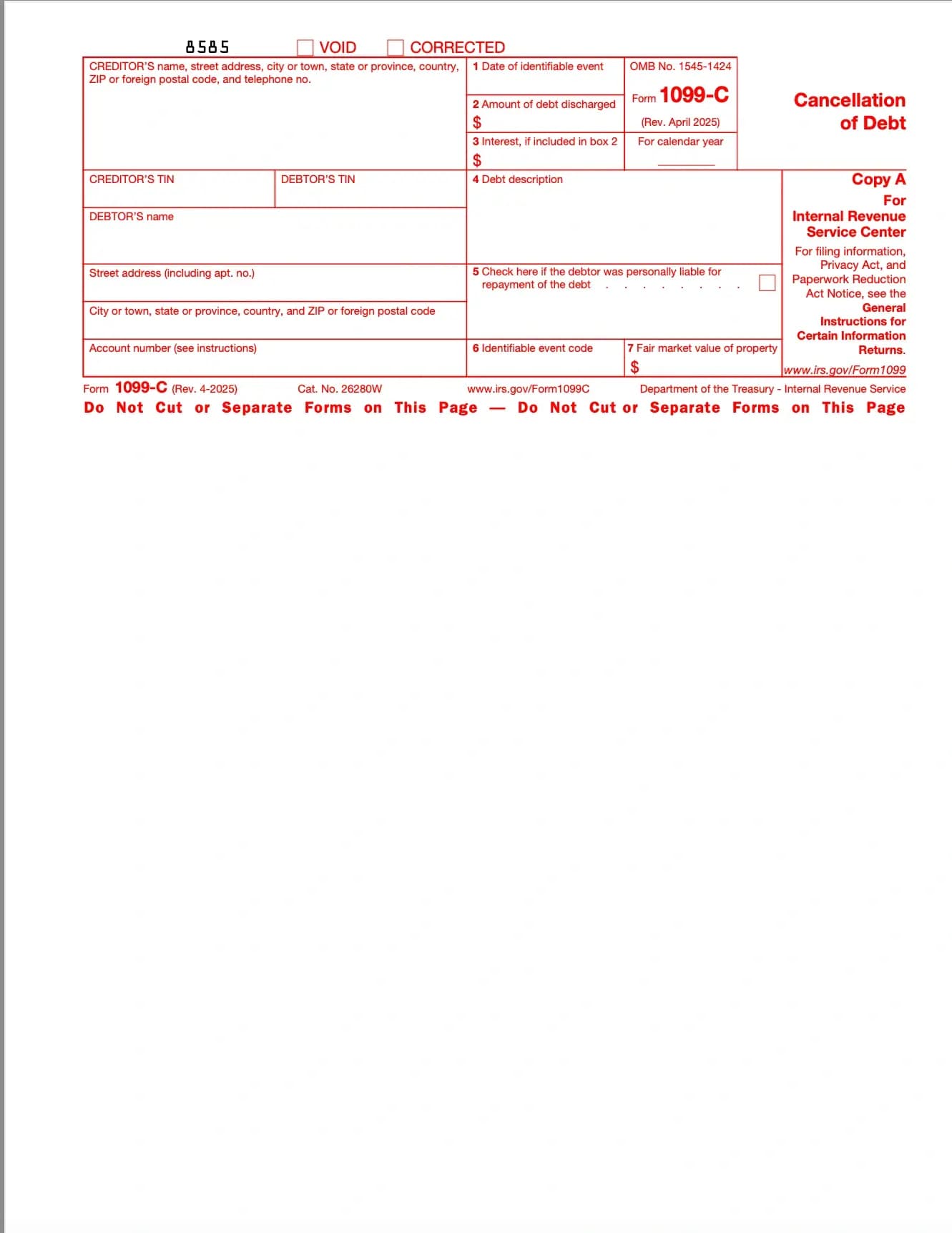

What is Form 1099-C?

Form 1099-C is an IRS information return used to report canceled or forgiven debt, typically when a lender forgives $600 or more of what you owe.

Who Should File Form 1099-C?

When Do You Receive Form 1099-C?

Borrowers typically receive Form 1099-C by January 31 of the year following the cancellation. The same information is also sent to the IRS.

Key Information Reported

Why is Form 1099-C Important?

How to Handle Form 1099-C

Processing Notes

Taxpayers who qualify for exclusions (like insolvency) must also file IRS Form 982 to claim the exception.

Preguntas frecuentes

1. Llenar el Formulario

Complete sus detalles e información, agregue fecha y personalice según sea necesario

2. Agregar Su Firma

Agregue firma legalmente vinculante dibujando, subiendo o escribiendo

3. Descargar o compartir

Su formulario está listo, descargue, comparta enlace o envíe por email instantáneamente