Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

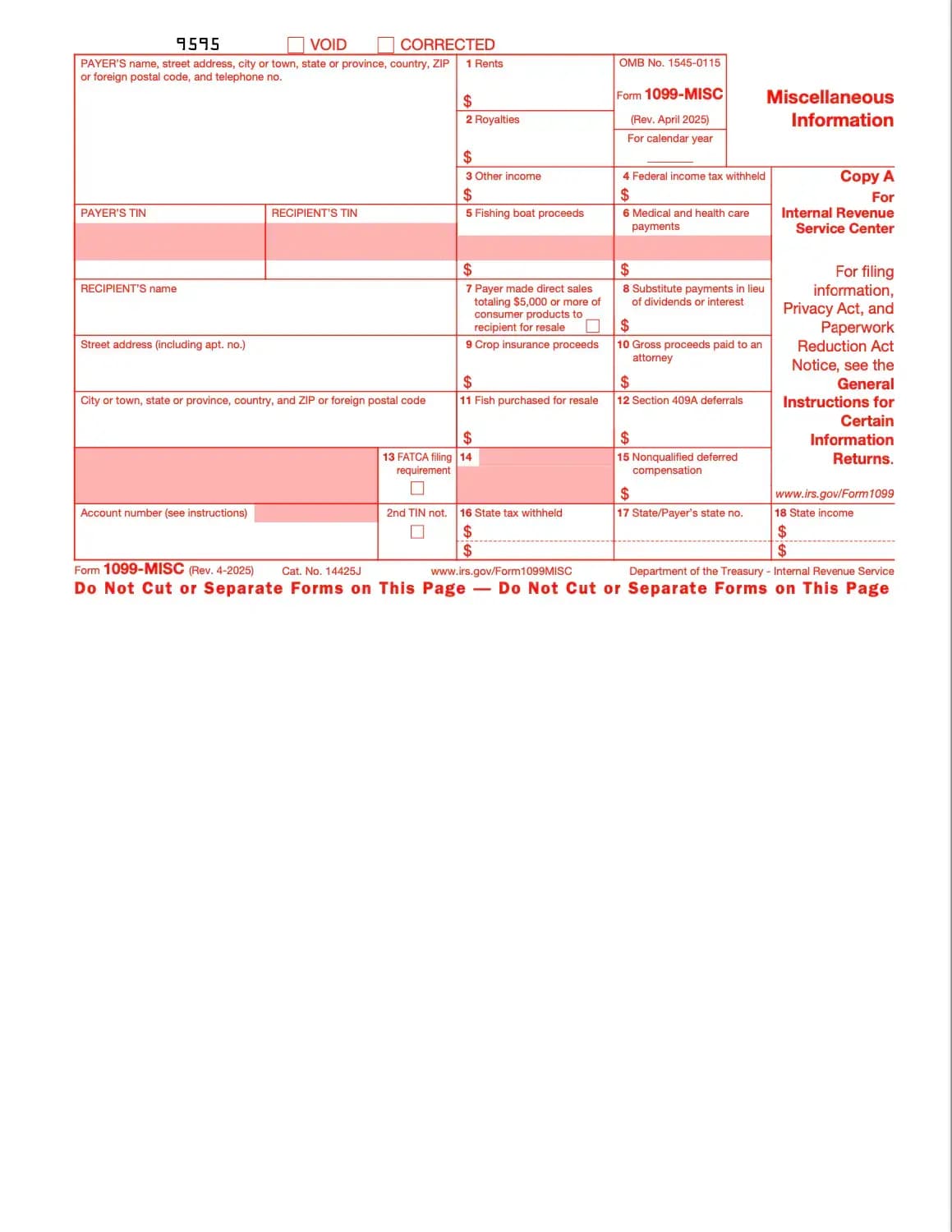

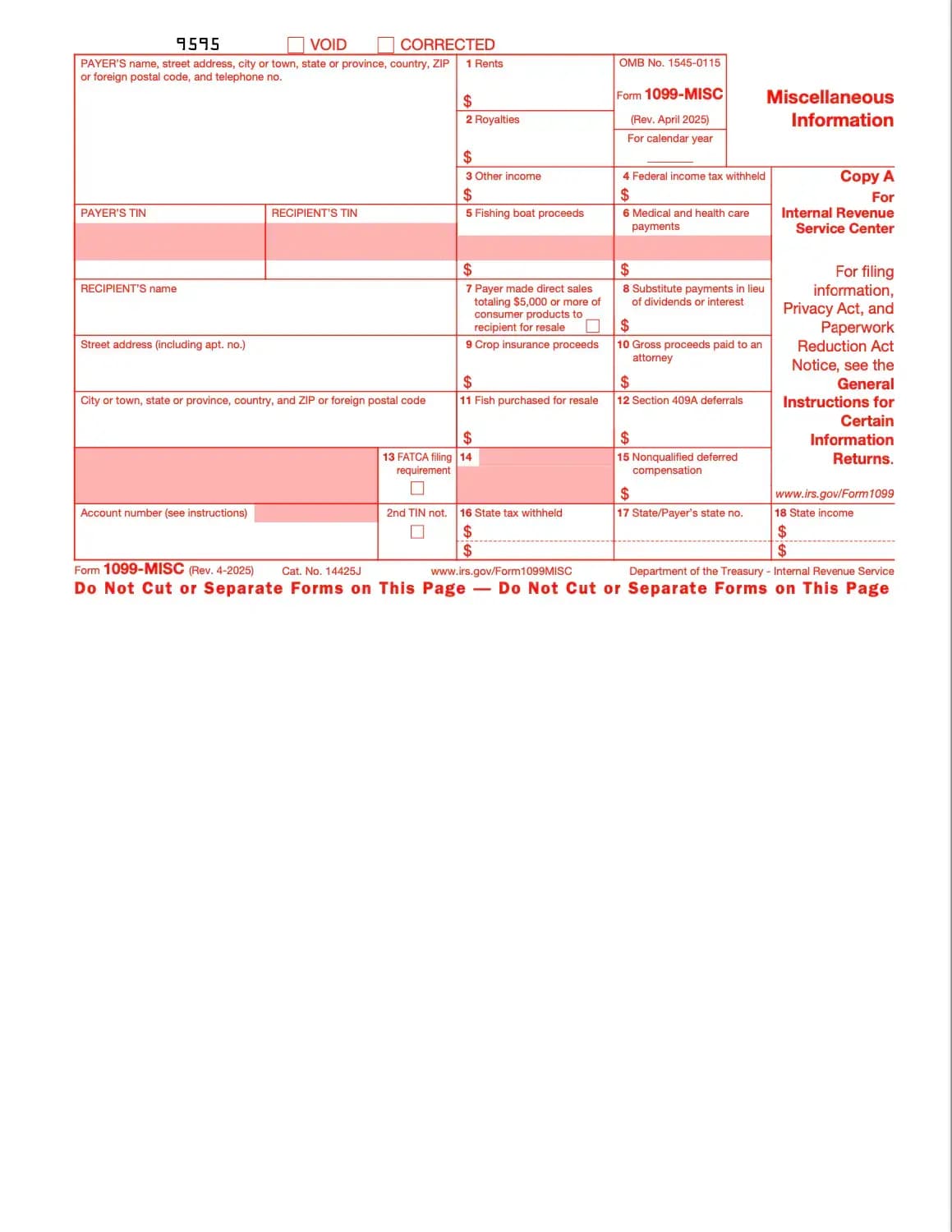

What is Form 1099-MISC?

The IRS 1099-MISC form is used to report miscellaneous income that doesn’t fall under regular wages or self-employment pay. It covers rent payments, royalties, prizes, awards, medical and healthcare payments, and other income categories.

Why is it important?

The IRS requires accurate reporting of all income. Recipients of 1099-MISC must include the amounts on their tax returns. Failing to report this income can result in penalties and interest.

Who must file Form 1099-MISC?

Businesses or individuals who paid:

What’s the difference between 1099-MISC and 1099-NEC?

What information is included?

When is it due?

常见问题

1. 填寫表單

填入您的詳細資料和資訊,新增日期並根據需要自訂

2. 新增您的簽名

透過繪製、上傳或輸入新增具有法律約束力的簽名

3. 下載或分享

您的表單已準備就緒,立即下載、分享連結或透過電子郵件發送