Everything You Need to Know About the 1099-NEC Form

What is the 1099-NEC?

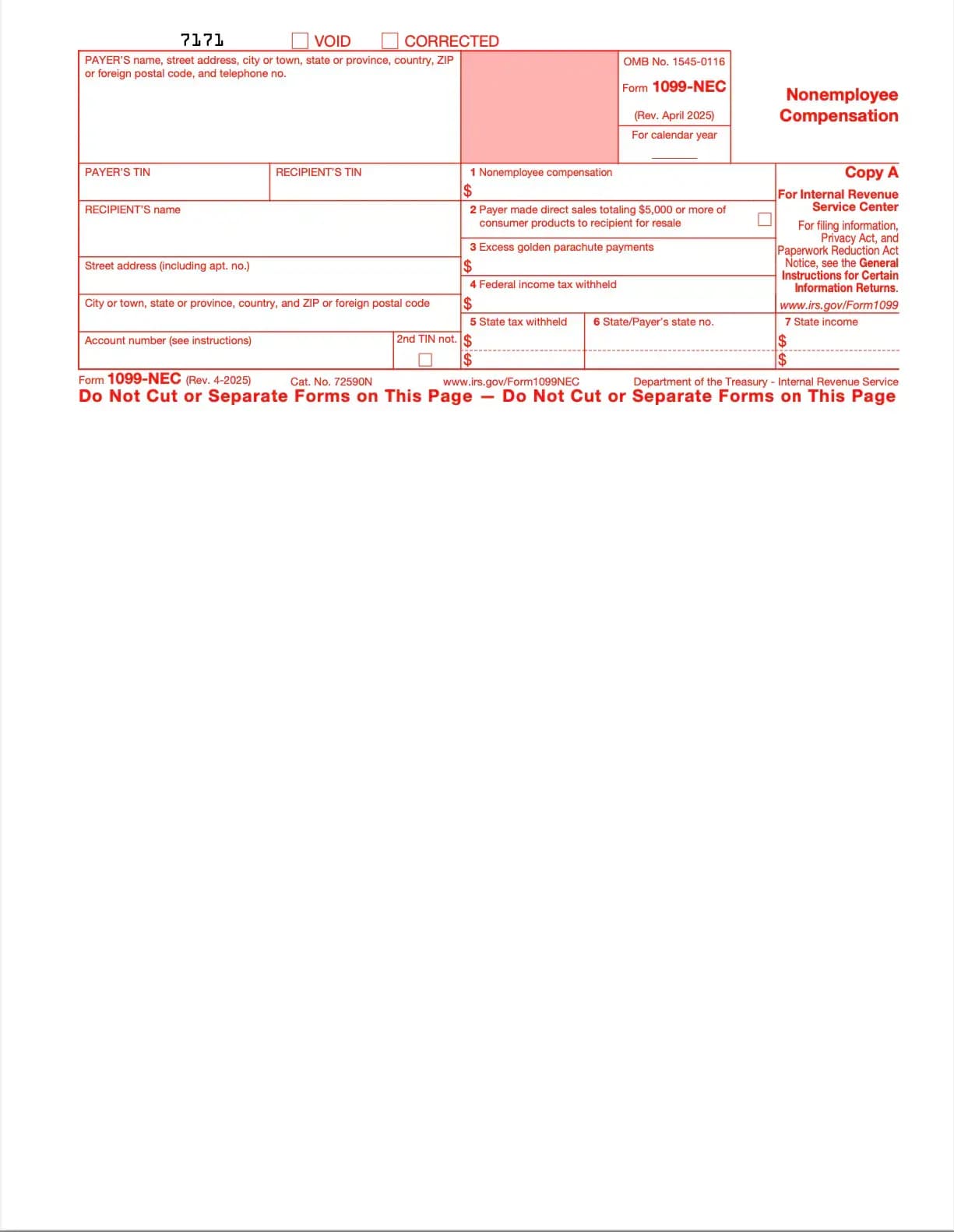

The IRS 1099-NEC (Nonemployee Compensation) is used by payers to report annual payments to contractors and service providers not treated as employees. Contractors then use this form to file their own tax returns.

Who gets a 1099-NEC?

- Any independent contractor earning $600 or more from one client in a year.

- Attorneys receiving $600+ in legal fees.

- Service providers such as consultants, designers, writers, drivers, and gig economy workers.

Who files the 1099-NEC?

- Businesses and individuals must issue one if they pay $600+ in a trade or business relationship.

- Payers must file Copy A with the IRS and send Copy B to the contractor.

Why is it important?

- For the IRS: Ensures accurate tracking of contractor income.

- For contractors: Provides proof of income needed for tax filing, mortgages, or loan applications.

- For payers: Avoids IRS penalties for failing to report required payments.

Deadlines

- January 31: Send Copy B to contractors and file with the IRS.

- If filing late, penalties range from $60 to $310 per form, depending on how late you file.

How to file the 1099-NEC

- Collect contractor details using Form W-9 (name, address, TIN/SSN/EIN).

- Fill out the 1099-NEC: report total compensation in Box 1.

- Send Copy B to the contractor by January 31.

- File Copy A with the IRS (e-file strongly recommended).

- Keep Copy C for your records.

Common mistakes to avoid

- Forgetting to issue the form if payments were $600+.

- Sending to employees instead of contractors (employees use W-2).

- Reporting payments processed via PayPal/Venmo (these go on 1099-K instead).

- Filing late or with incorrect taxpayer info.