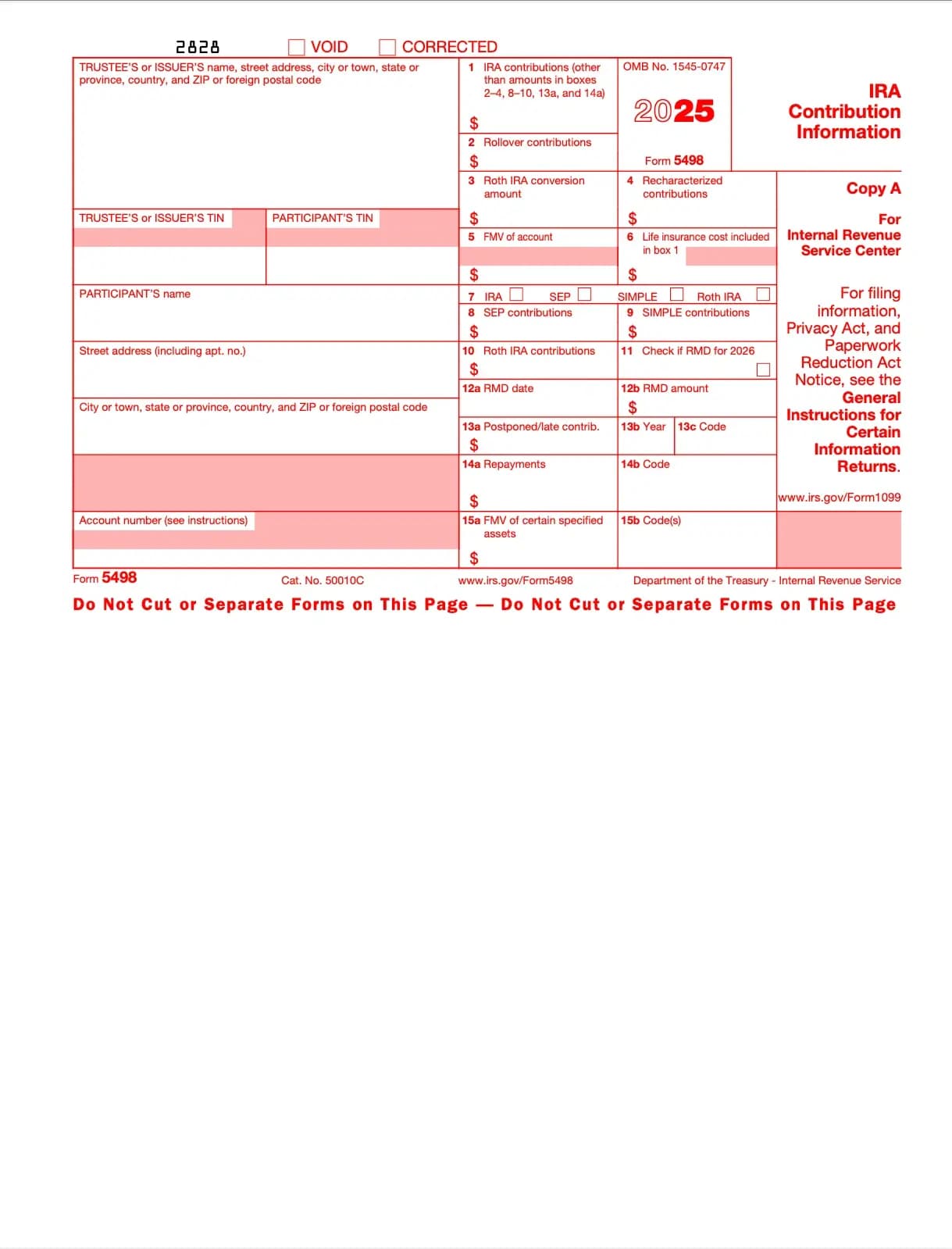

Fill Out IRS Form 5498 – IRA Contribution Information

银行级安全保障,100% 隐私保护

Zendocs is not affiliated with the Internal Revenue Service (IRS).

What is Form 5498?

Form 5498 reports IRA activity, including annual contributions, rollovers, fair market value (FMV), and required minimum distributions (RMD) notices.

Who Files Form 5498?

When is Form 5498 Due?

Key Information Reported

Why is Form 5498 Important?

常见问题

1. 填寫表單

填入您的詳細資料和資訊,新增日期並根據需要自訂

2. 新增您的簽名

透過繪製、上傳或輸入新增具有法律約束力的簽名

3. 下載或分享

您的表單已準備就緒,立即下載、分享連結或透過電子郵件發送