Everything You Need to Know About Form 8821 - Tax Information Authorization

What is Form 8821?

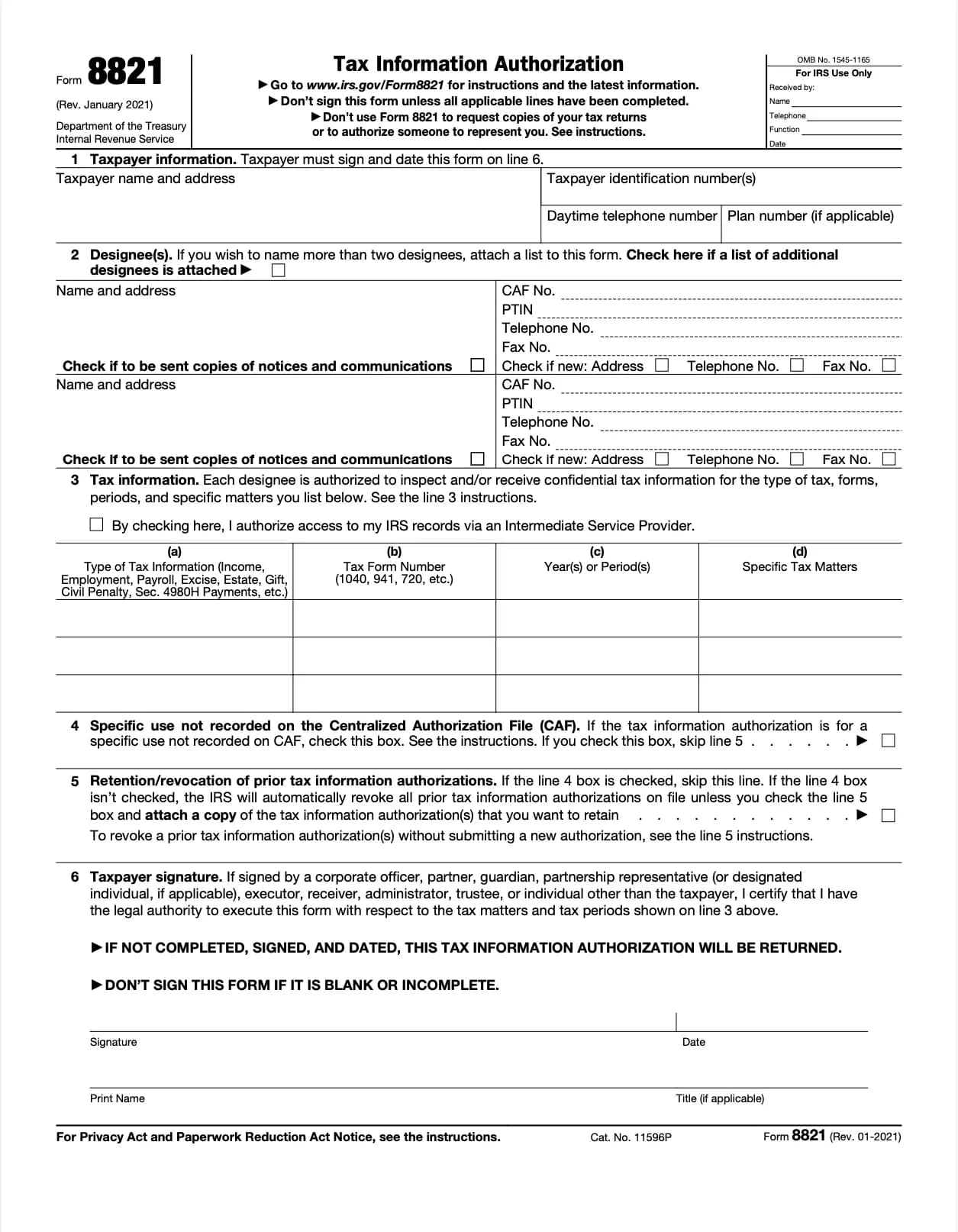

Form 8821, officially known as the Tax Information Authorization, allows you to grant permission for a third party,such as an accountant, tax advisor, or business representative,to access and review your IRS tax information. The authorized individual or organization can receive IRS notices, obtain copies of tax records, and communicate directly with the IRS about the specified tax years or issues.

Who Should File Form 8821?

- Taxpayers who want their accountant or preparer to receive IRS updates directly

- Businesses authorizing a professional to manage tax-related communication

- Individuals seeking help resolving IRS notices or reviewing past filings

- Anyone needing to give limited access to a tax professional for compliance purposes

When to File Form 8821?

- Before a tax audit or when updating tax filings

- When hiring or changing a tax representative or firm

- When delegating authority for specific tax information access

Key Information Required

- Taxpayer’s name, address, and Taxpayer Identification Number (TIN)

- Authorized representative’s name, address, and contact details

- Type of tax and years covered

- Signature and date from the taxpayer or business officer

Why is Form 8821 Important?

- Allows secure, limited access to your IRS tax information

- Streamlines communication between your representative and the IRS

- Reduces administrative delays when resolving tax matters

- Helps ensure transparency and organization in tax correspondence

How to File Form 8821

- Download the form from Zendocs.

- Fill out and sign the appropriate sections.

- Mail or fax it to the address listed on the form (varies by state).

Processing Notes

Once submitted, the IRS typically processes Form 8821 within 5-10 business days, after which the authorized party can access your designated tax records.