Everything You Need to Know About IRS Form 8863

What is Form 8863?

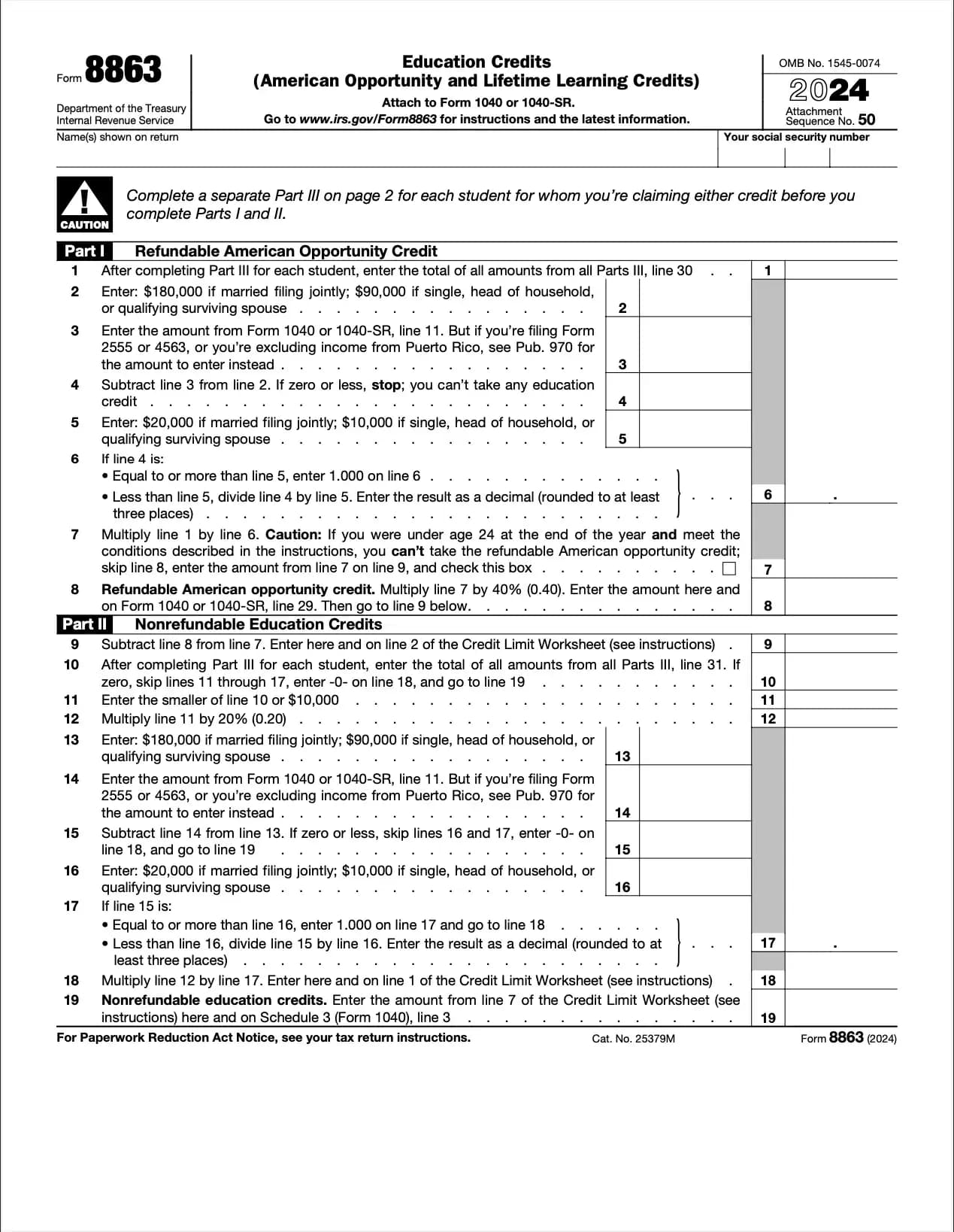

Form 8863 lets taxpayers claim education-related credits that lower their tax liability. Unlike deductions, these credits directly reduce the tax you owe — and in the case of the AOTC, may even result in a refund.

Types of Education Credits on Form 8863

- American Opportunity Tax Credit (AOTC)

- Up to $2,500 per eligible student.

- Covers the first four years of higher education.

- 40% refundable (up to $1,000) even if you owe no tax.

- Qualified expenses: tuition, fees, and required course materials.

- Lifetime Learning Credit (LLC)

- Up to $2,000 per tax return.

- No limit on the number of years you can claim it.

- Covers tuition and fees for undergraduate, graduate, or professional courses.

- Nonrefundable — it can reduce tax to zero but won’t generate a refund.

Who Can File Form 8863?

- U.S. taxpayers paying tuition or fees for themselves, their spouse, or dependents.

- Students enrolled at least half-time in an eligible degree or credential program (for AOTC).

- Taxpayers meeting income requirements: credits phase out at higher income levels.

Key Information Needed

- Student’s name, Social Security Number (SSN), and enrollment details.

- Form 1098-T from the school reporting tuition payments.

- Documentation of qualified expenses not shown on the 1098-T (like books).

When is it due?

- File with your tax return by April 15, 2026.

- Extended deadline is October 15, 2026 with Form 4868.

Why is it important?

These credits help offset the rising cost of higher education. Claiming them can save thousands of dollars in taxes and free up more funds for tuition, living expenses, or future savings.