Everything You Need to Know About the Promissory Note Template

What Is a Promissory Note Template?

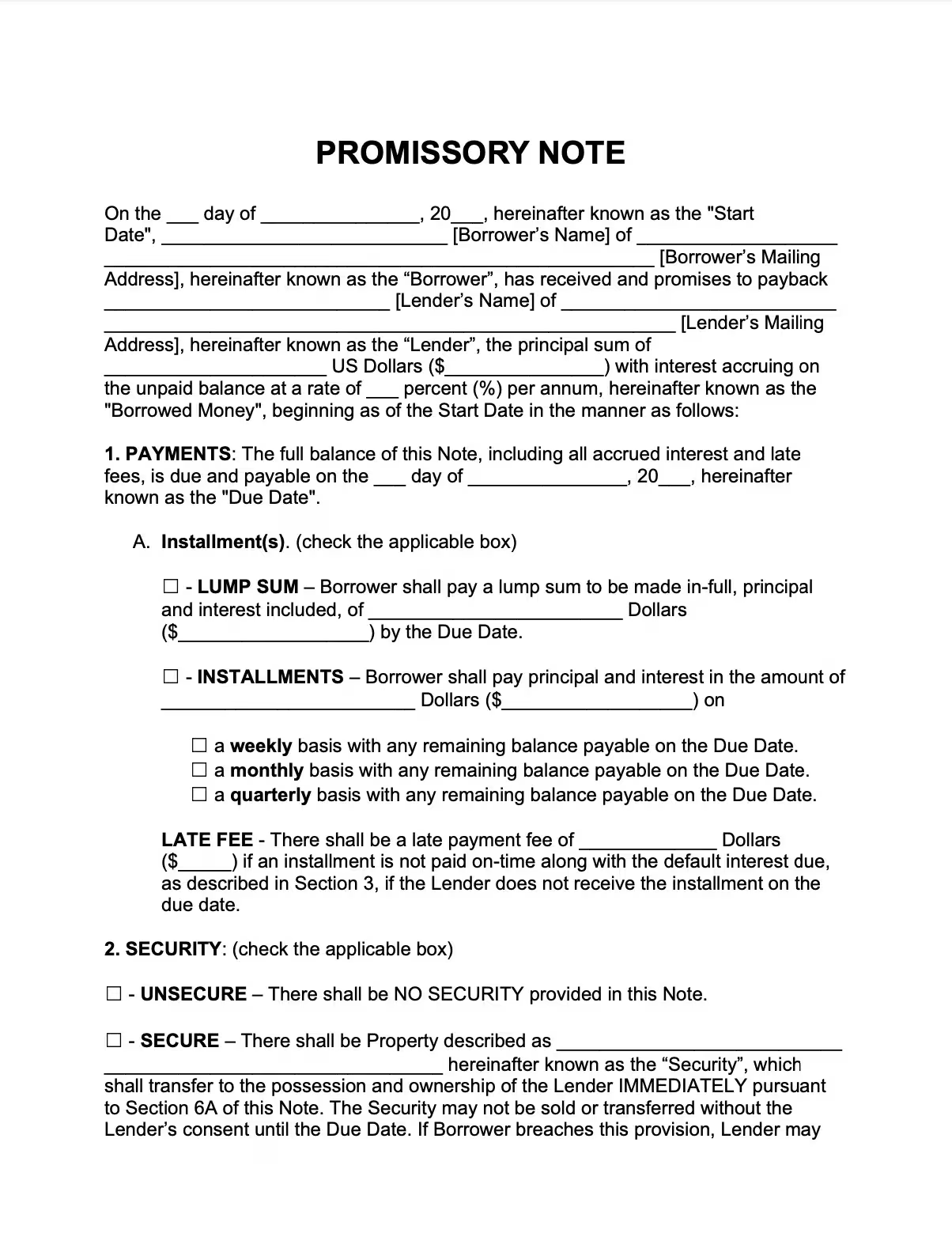

A Promissory Note Template is a legal document that records the terms of a loan between a borrower and a lender. It ensures both parties agree on repayment amount, schedule, interest rate, and consequences of default. Our Fillable Promissory Note Template allows easy customization to meet your specific needs, making it a practical solution for personal and business loans.

Who Should Use a Promissory Note?

Promissory Notes are suitable for:

- Individuals lending or borrowing money privately (friends, family, or partners)

- Businesses offering financing or extending credit to clients

- Investors providing personal loans or startup capital

- Real estate transactions, equipment leasing, or secured lending arrangements

Key Details Included in a Promissory Note

A comprehensive Promissory Note typically includes:

- Principal amount - total money borrowed

- Interest rate - fixed or variable rate applied to the loan

- Repayment schedule - frequency and duration of payments

- Collateral - any property or asset pledged as security

- Late fees and penalties - charges for missed or delayed payments

- Default terms - what happens if the borrower fails to pay

- Governing law - which state’s law applies to the agreement

Why Use Our Fillable Promissory Note Template?

Using our Promissory Note Template:

- Saves time with an easy fillable format

- Ensures legal clarity and enforceability

- Provides clear documentation to protect your interests

- Is customizable to your loan agreement specifics