Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

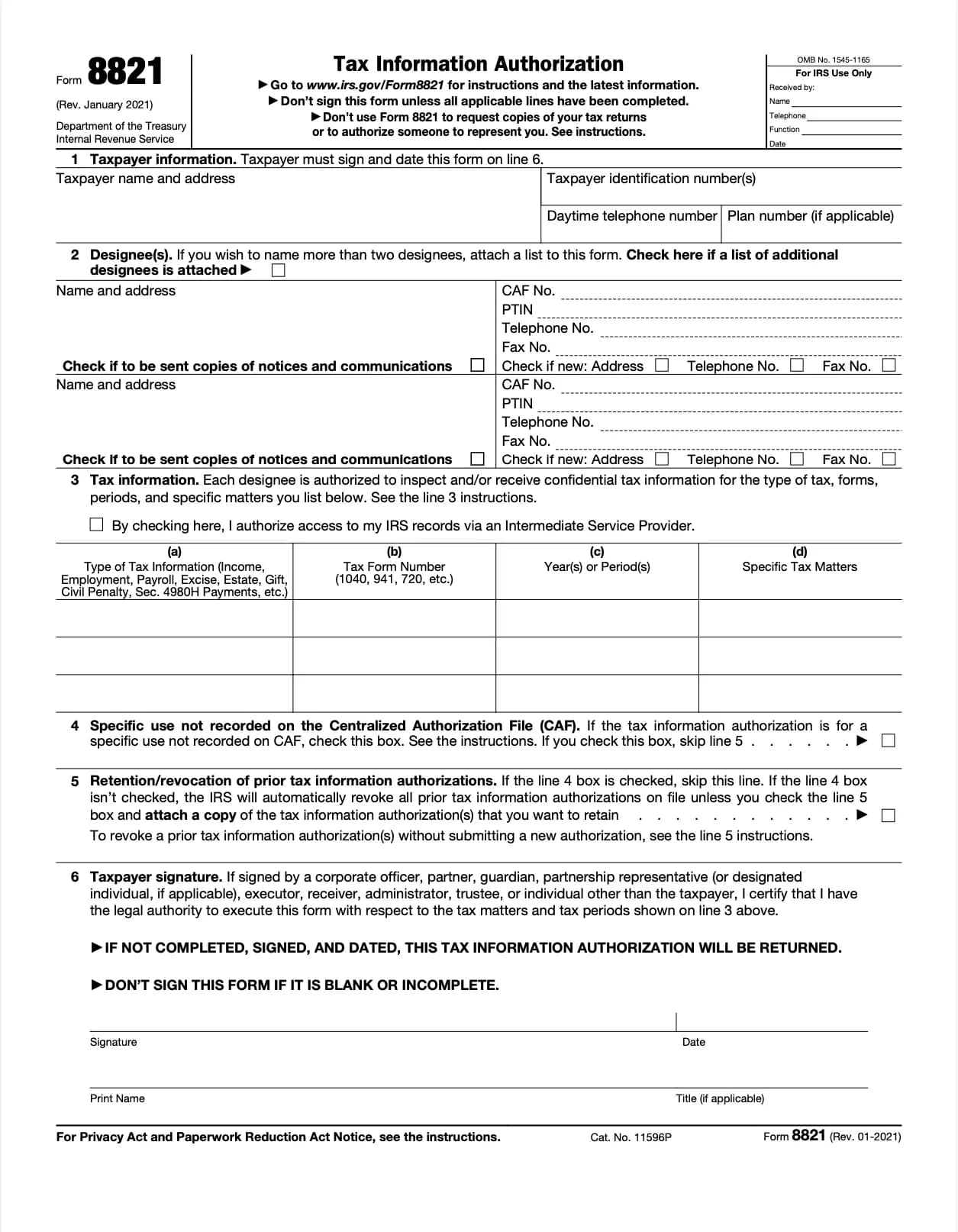

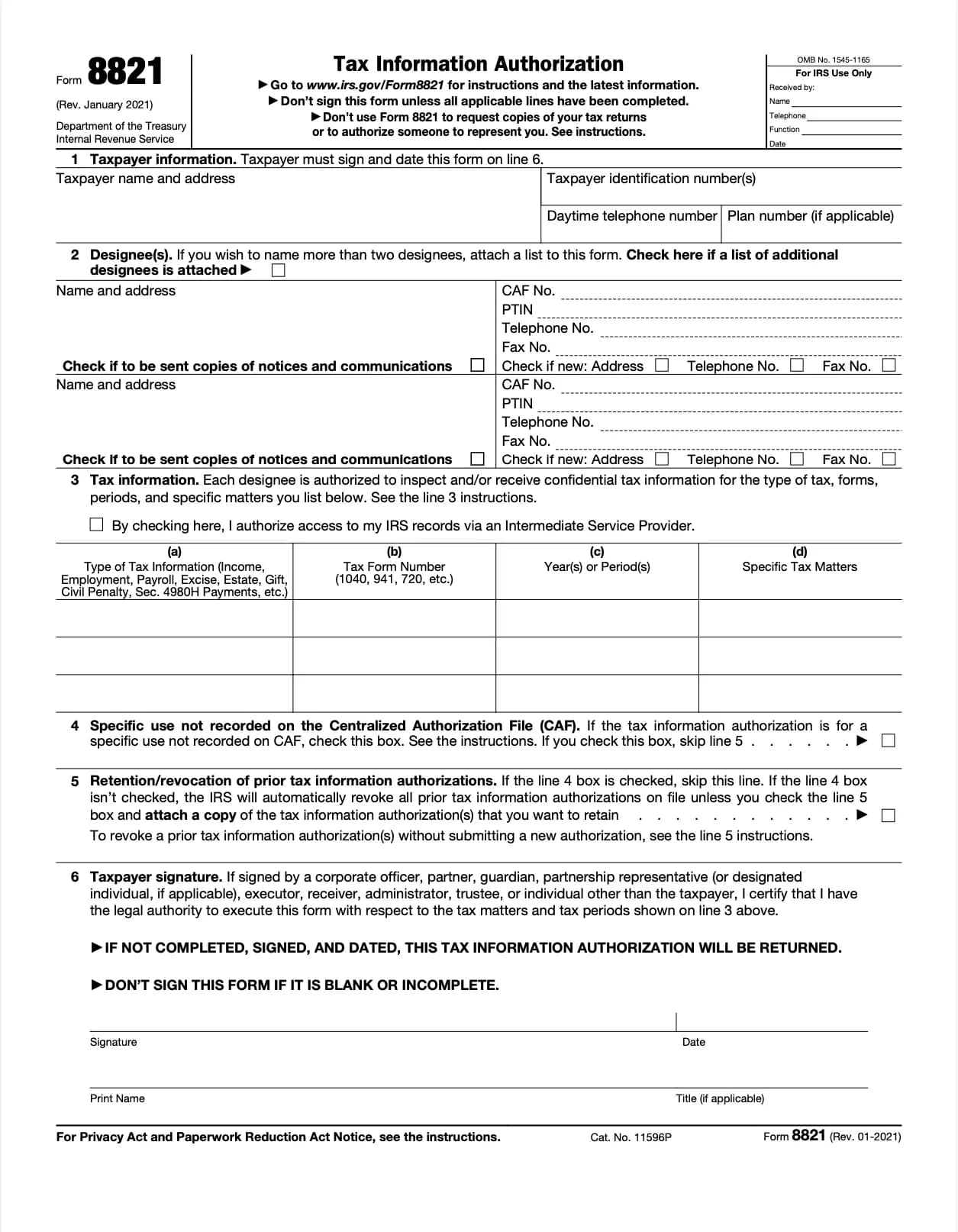

Form 8821, officially known as the Tax Information Authorization, allows you to grant permission for a third party,such as an accountant, tax advisor, or business representative,to access and review your IRS tax information. The authorized individual or organization can receive IRS notices, obtain copies of tax records, and communicate directly with the IRS about the specified tax years or issues.

Once submitted, the IRS typically processes Form 8821 within 5-10 business days, after which the authorized party can access your designated tax records.

Často kladené otázky

1. Vyplnit formulář

Vyplňte své údaje a informace, přidejte datum a přizpůsobte podle potřeby

2. Přidat svůj podpis

Přidejte právně závazný podpis kreslením, nahráním nebo psaním

3. Stáhnout nebo sdílet

Váš formulář je připraven, stáhněte, sdílejte odkaz nebo pošlete e-mailem okamžitě