Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

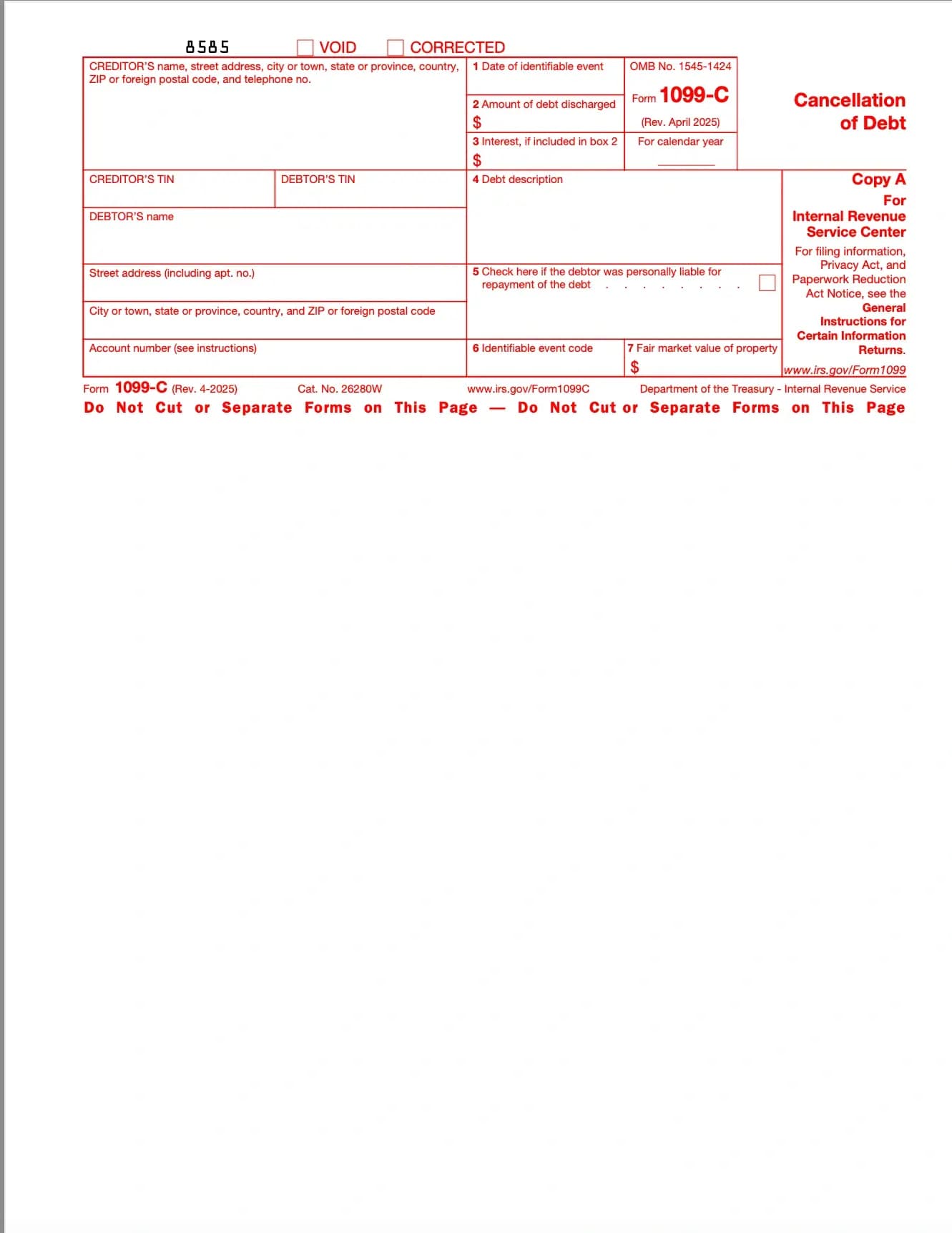

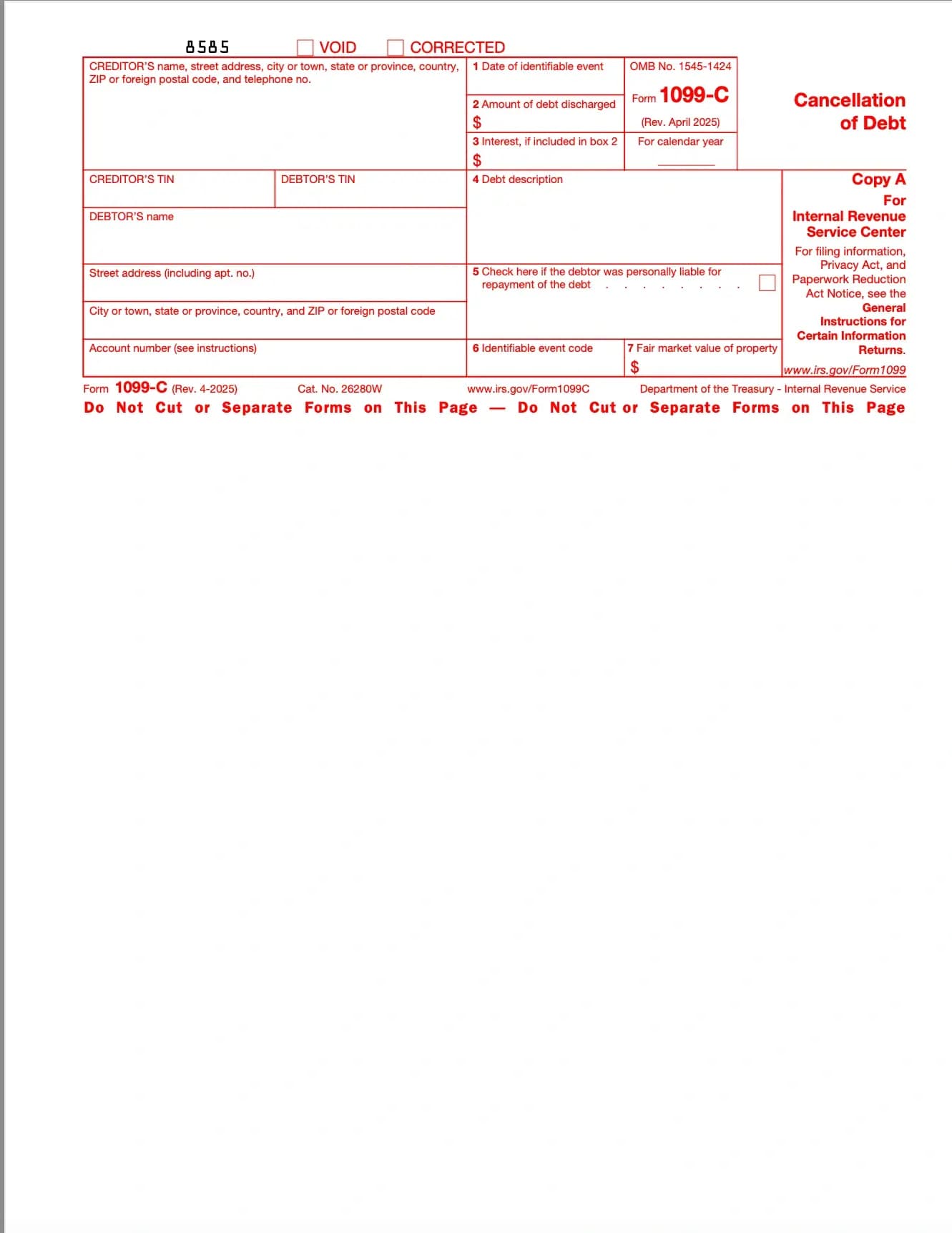

What is Form 1099-C?

Form 1099-C is an IRS information return used to report canceled or forgiven debt, typically when a lender forgives $600 or more of what you owe.

Who Should File Form 1099-C?

When Do You Receive Form 1099-C?

Borrowers typically receive Form 1099-C by January 31 of the year following the cancellation. The same information is also sent to the IRS.

Key Information Reported

Why is Form 1099-C Important?

How to Handle Form 1099-C

Processing Notes

Taxpayers who qualify for exclusions (like insolvency) must also file IRS Form 982 to claim the exception.

자주 묻는 질문

1. 양식 작성

세부 정보와 정보를 입력하고, 날짜를 추가하고 필요에 따라 사용자 정의하세요

2. 서명 추가

그리기, 업로드 또는 타이핑으로 법적 구속력이 있는 서명을 추가하세요

3. 다운로드 또는 공유

양식이 준비되었습니다. 즉시 다운로드하거나 링크를 공유하거나 이메일로 보내세요