Fill Out Form 8863: Claim Education Credits for College Expenses

은행 수준의 보안 및 100% 개인정보 보호

Zendocs is not affiliated with the IRS.

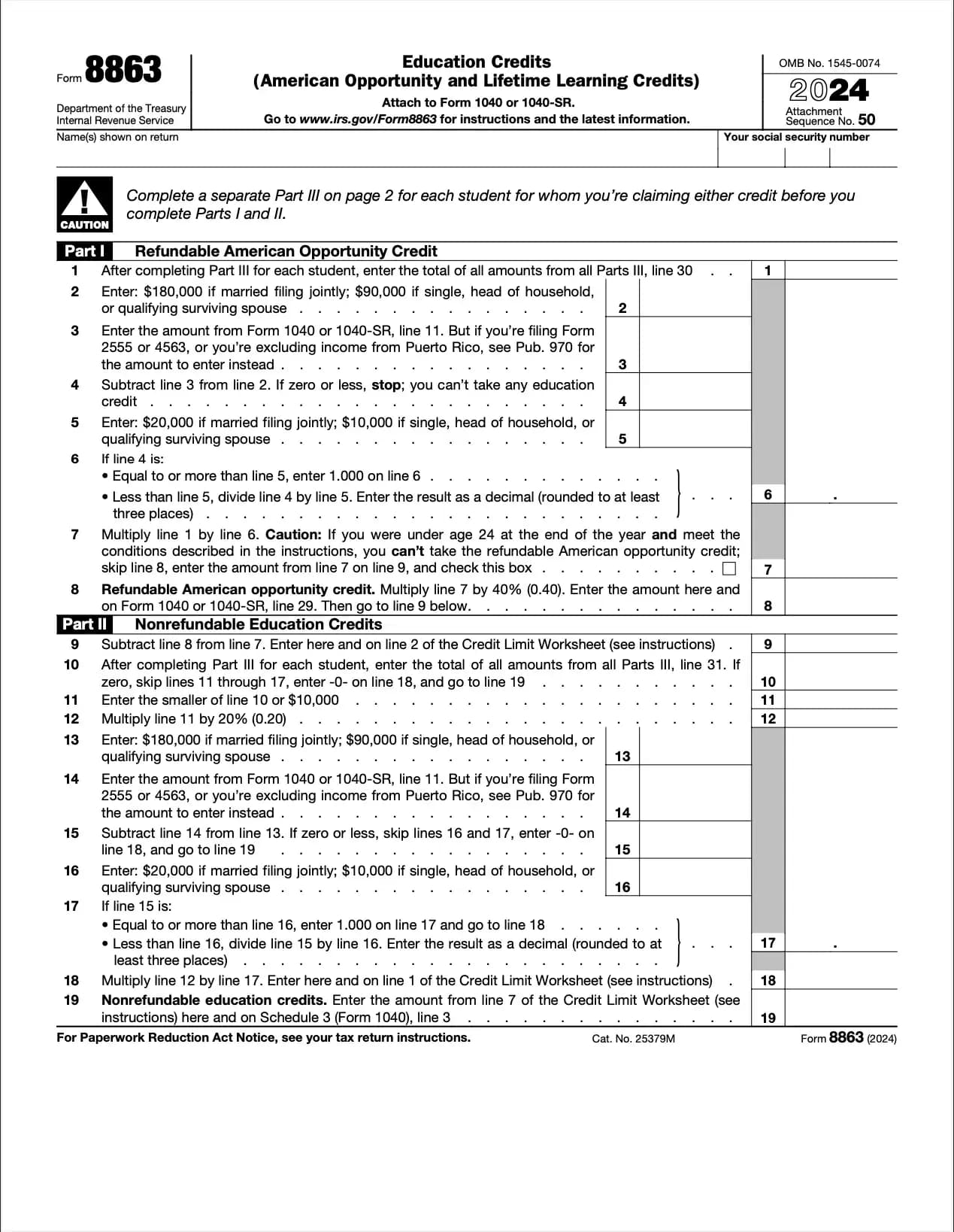

What is Form 8863?

Form 8863 lets taxpayers claim education-related credits that lower their tax liability. Unlike deductions, these credits directly reduce the tax you owe — and in the case of the AOTC, may even result in a refund.

Types of Education Credits on Form 8863

Who Can File Form 8863?

Key Information Needed

When is it due?

Why is it important?

These credits help offset the rising cost of higher education. Claiming them can save thousands of dollars in taxes and free up more funds for tuition, living expenses, or future savings.

자주 묻는 질문

1. 양식 작성

세부 정보와 정보를 입력하고, 날짜를 추가하고 필요에 따라 사용자 정의하세요

2. 서명 추가

그리기, 업로드 또는 타이핑으로 법적 구속력이 있는 서명을 추가하세요

3. 다운로드 또는 공유

양식이 준비되었습니다. 즉시 다운로드하거나 링크를 공유하거나 이메일로 보내세요