Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

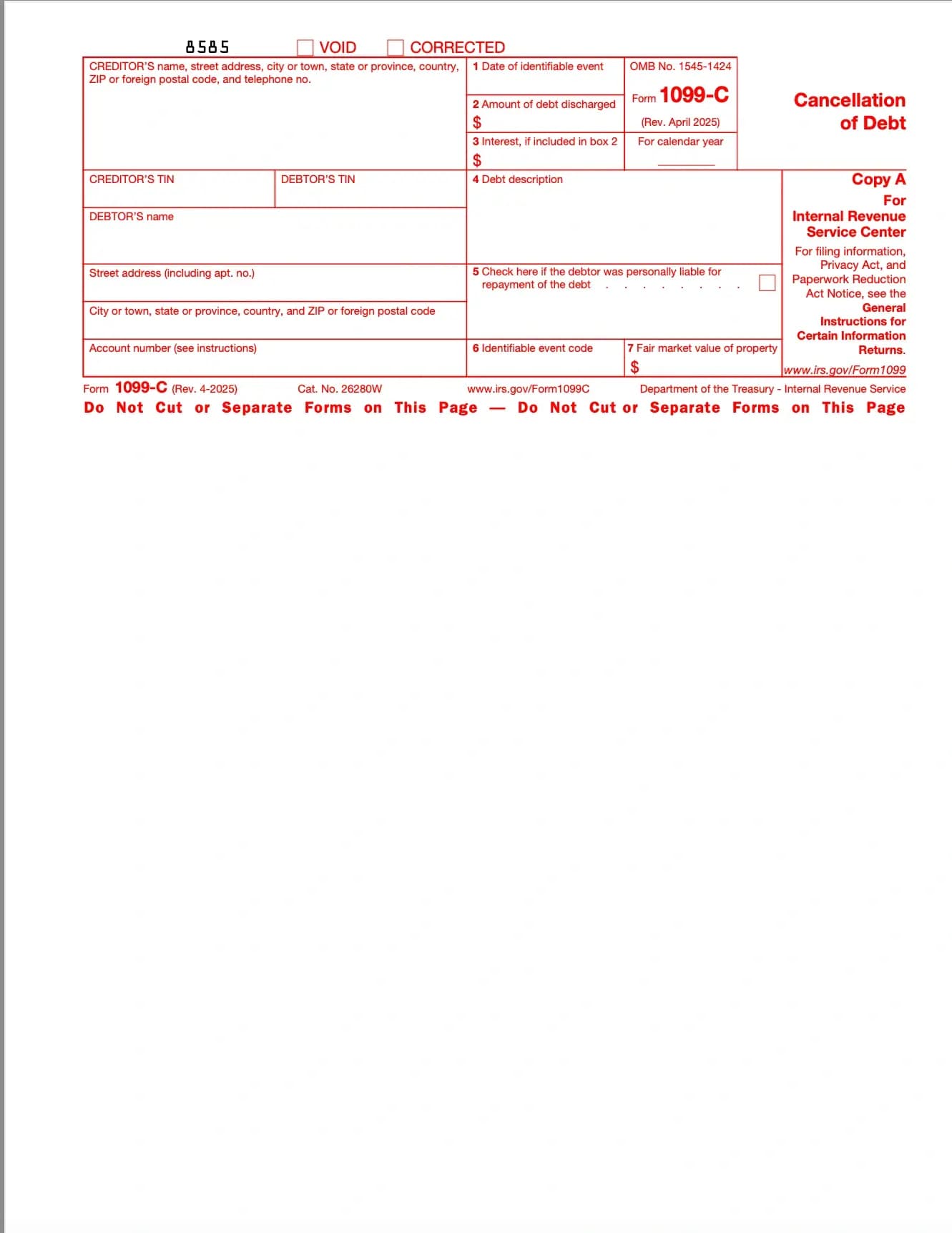

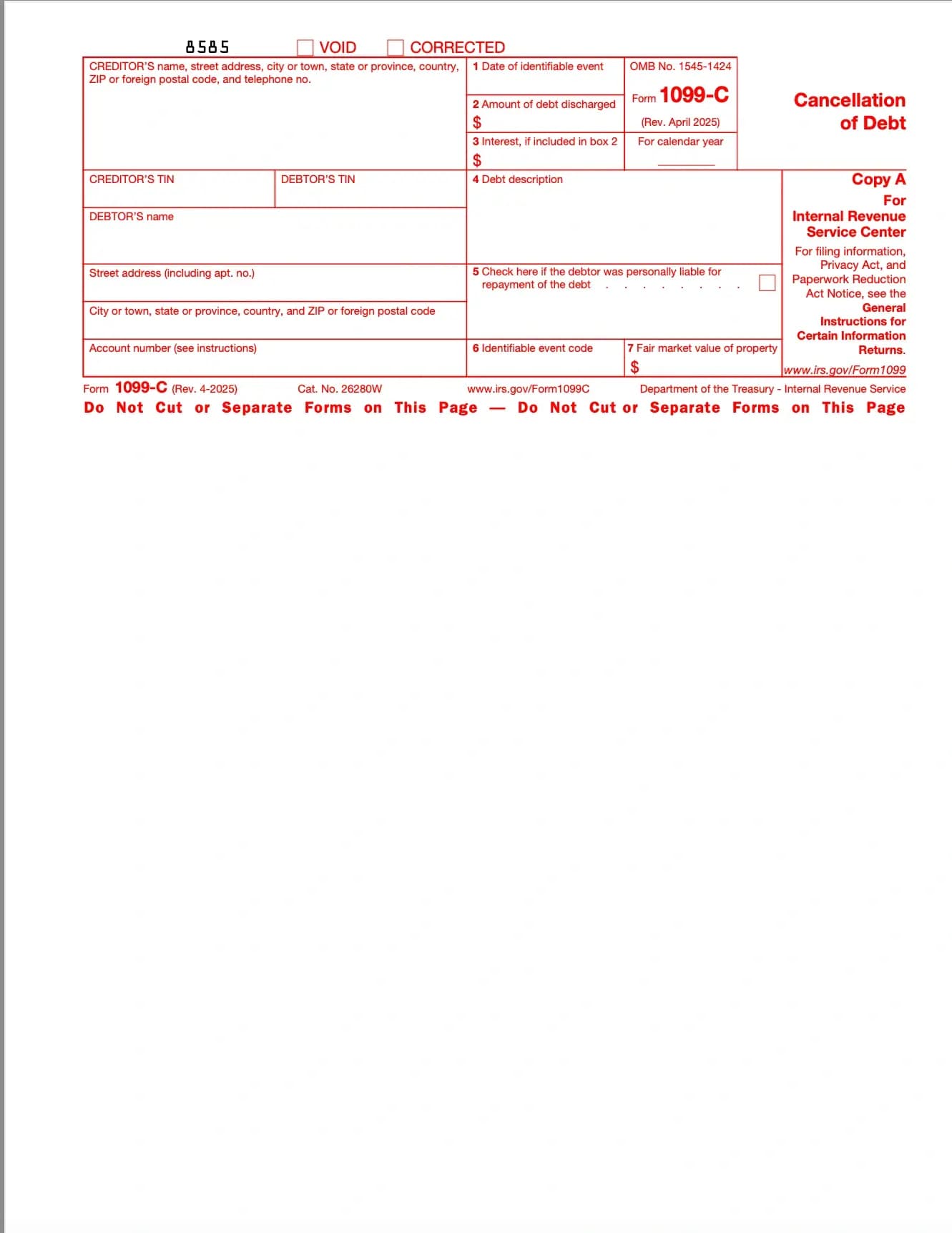

What is Form 1099-C?

Form 1099-C is an IRS information return used to report canceled or forgiven debt, typically when a lender forgives $600 or more of what you owe.

Who Should File Form 1099-C?

When Do You Receive Form 1099-C?

Borrowers typically receive Form 1099-C by January 31 of the year following the cancellation. The same information is also sent to the IRS.

Key Information Reported

Why is Form 1099-C Important?

How to Handle Form 1099-C

Processing Notes

Taxpayers who qualify for exclusions (like insolvency) must also file IRS Form 982 to claim the exception.

Perguntas frequentes

1. Preencha o Formulário

Preencha seus detalhes e informações, adicione data e personalize conforme necessário

2. Adicione Sua Assinatura

Adicione assinatura legalmente vinculativa desenhando, carregando ou digitando

3. Baixe ou compartilhe

Seu formulário está pronto, baixe, compartilhe link ou envie por e-mail instantaneamente