Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

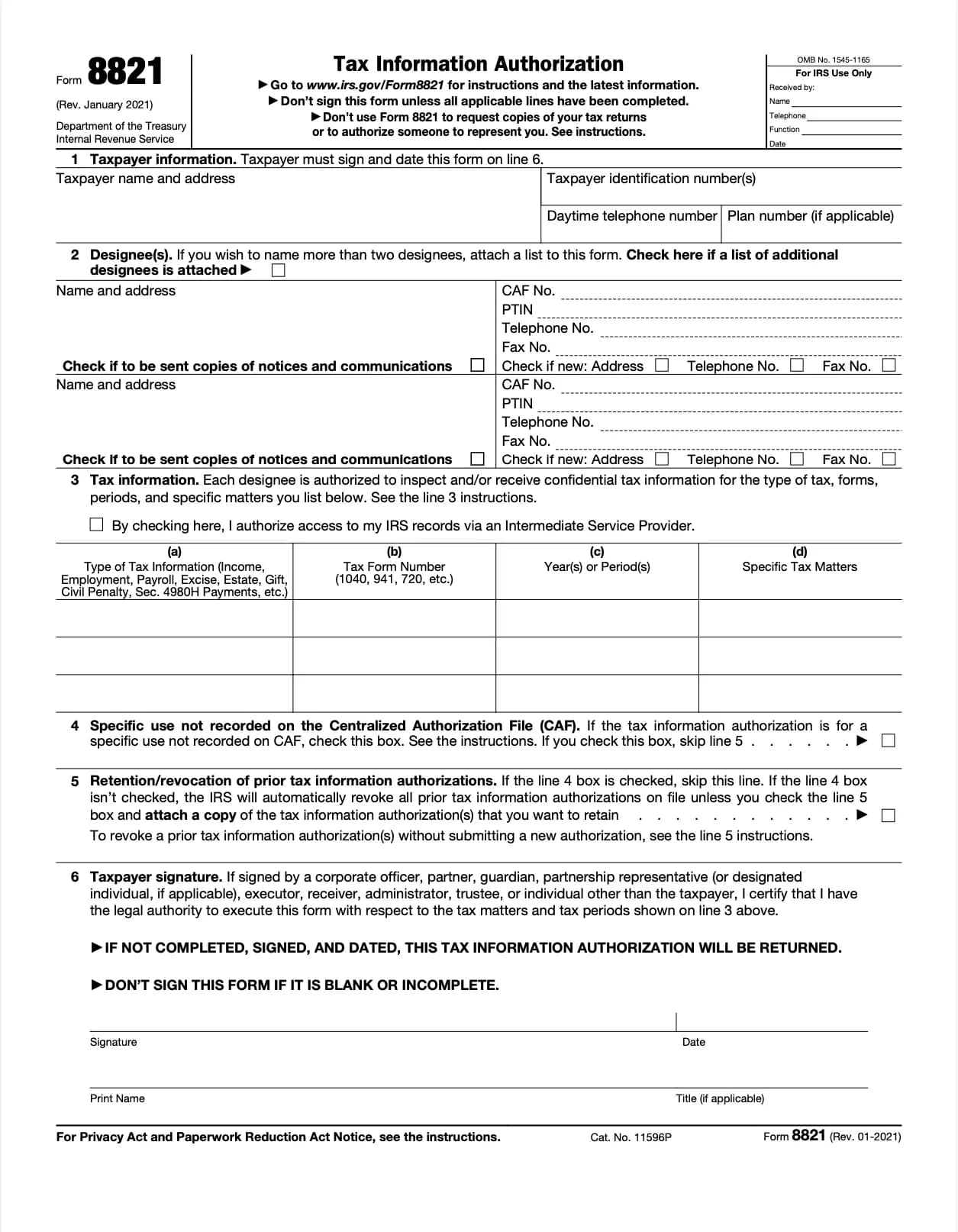

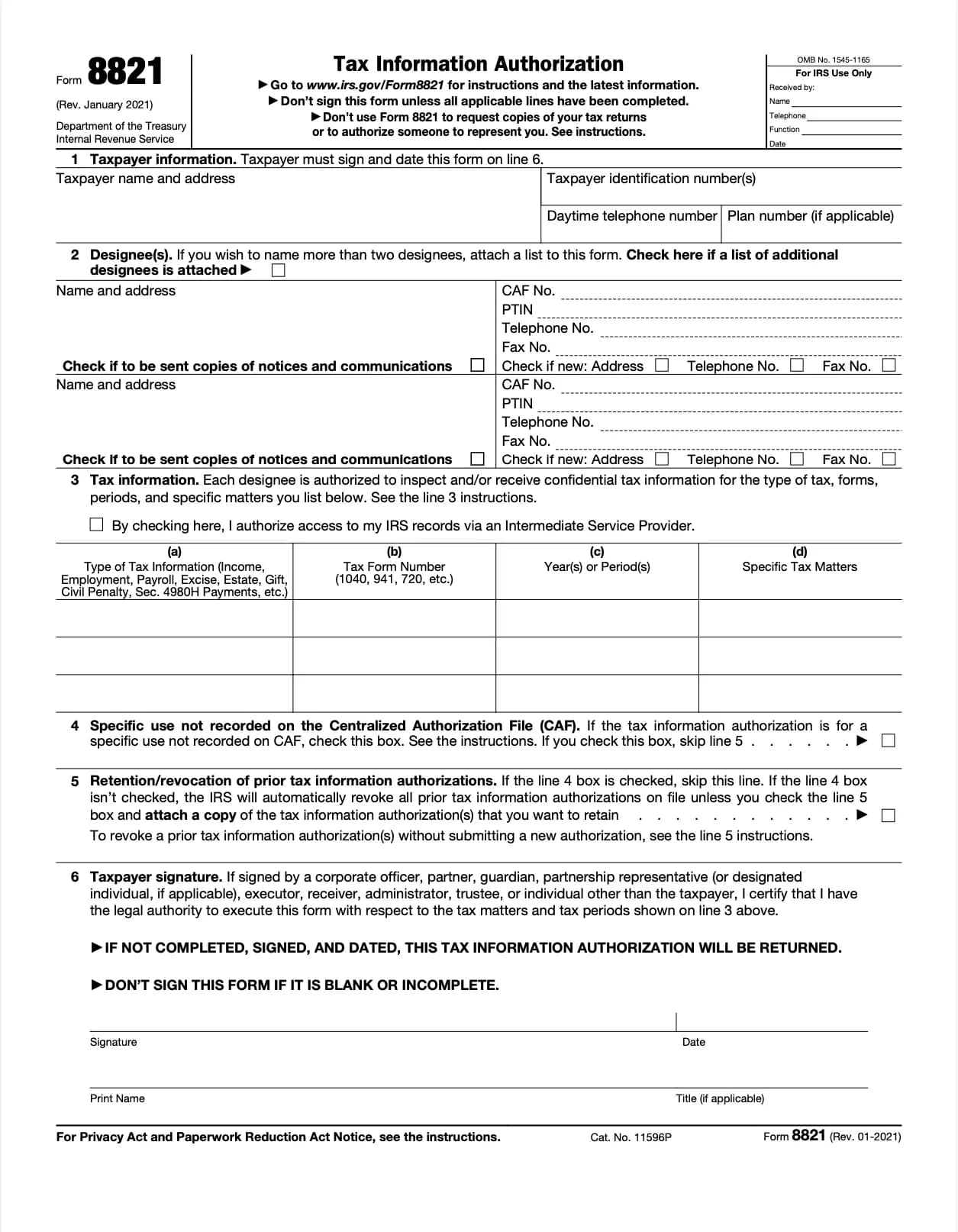

Form 8821, officially known as the Tax Information Authorization, allows you to grant permission for a third party,such as an accountant, tax advisor, or business representative,to access and review your IRS tax information. The authorized individual or organization can receive IRS notices, obtain copies of tax records, and communicate directly with the IRS about the specified tax years or issues.

Once submitted, the IRS typically processes Form 8821 within 5-10 business days, after which the authorized party can access your designated tax records.

Vanliga frågor och svar

1. Fyll i formuläret

Fyll i dina uppgifter och information, lägg till datum och anpassa efter behov

2. Lägg till din signatur

Lägg till juridiskt bindande signatur genom att rita, ladda upp eller skriva

3. Ladda ner eller dela

Ditt formulär är klart, ladda ner, dela länk eller skicka via e-post omedelbart