Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

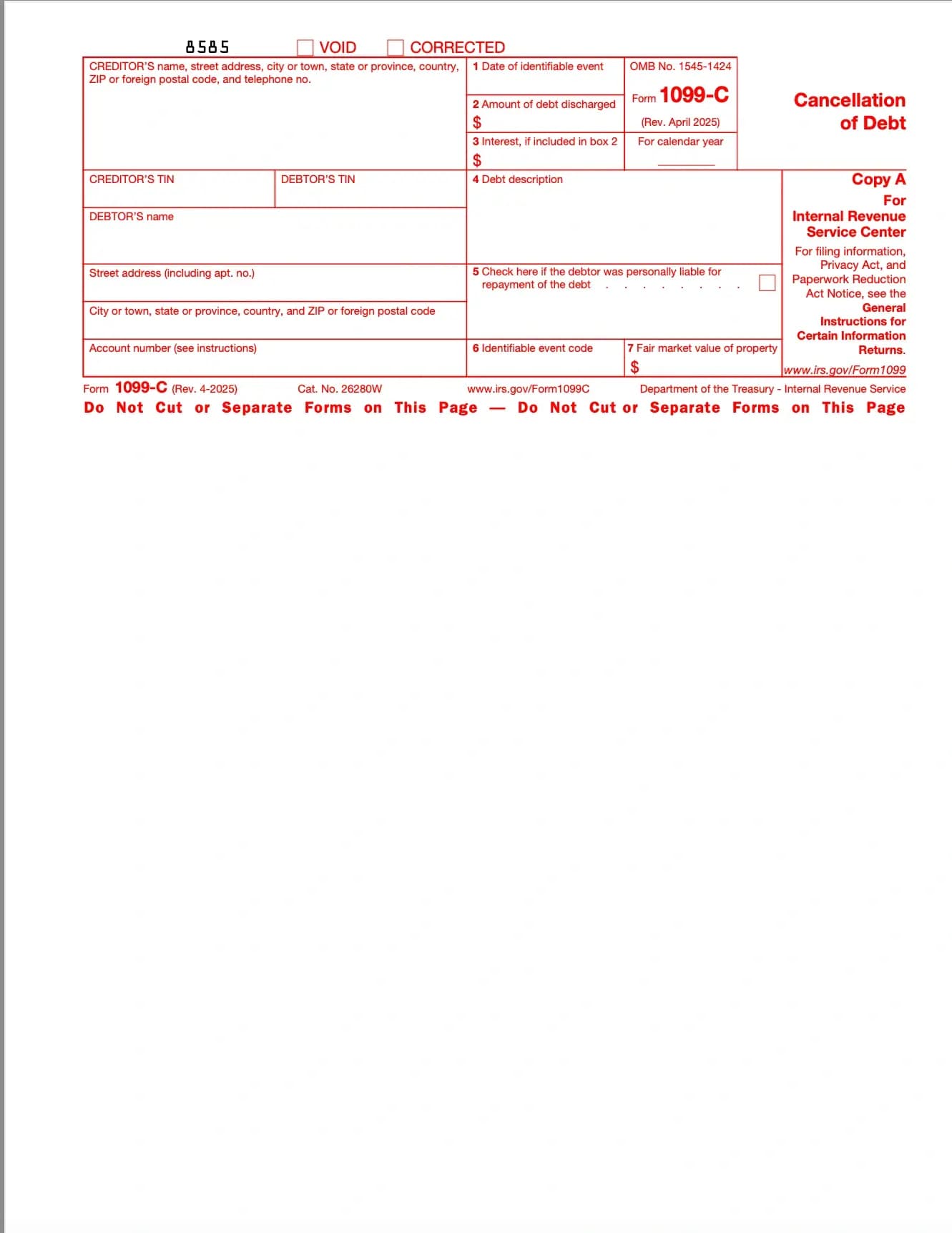

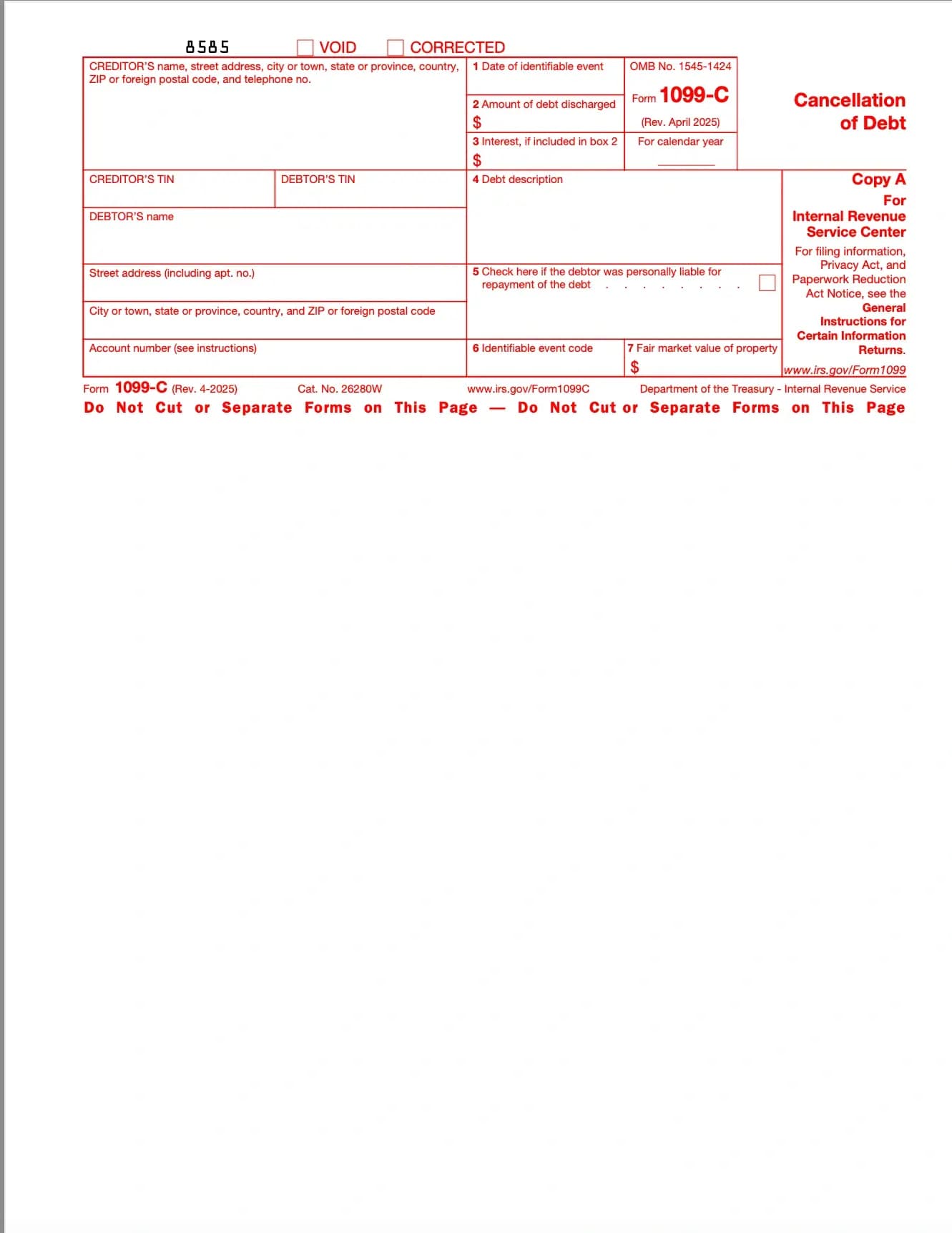

What is Form 1099-C?

Form 1099-C is an IRS information return used to report canceled or forgiven debt, typically when a lender forgives $600 or more of what you owe.

Who Should File Form 1099-C?

When Do You Receive Form 1099-C?

Borrowers typically receive Form 1099-C by January 31 of the year following the cancellation. The same information is also sent to the IRS.

Key Information Reported

Why is Form 1099-C Important?

How to Handle Form 1099-C

Processing Notes

Taxpayers who qualify for exclusions (like insolvency) must also file IRS Form 982 to claim the exception.

Ofte stillede spørgsmål

1. Udfyld formularen

Udfyld dine detaljer og oplysninger, tilføj dato og tilpas efter behov

2. Tilføj din signatur

Tilføj juridisk bindende signatur ved at tegne, uploade eller skrive

3. Download eller del

Din formular er klar, download, del link eller send via e-mail øjeblikkeligt