Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

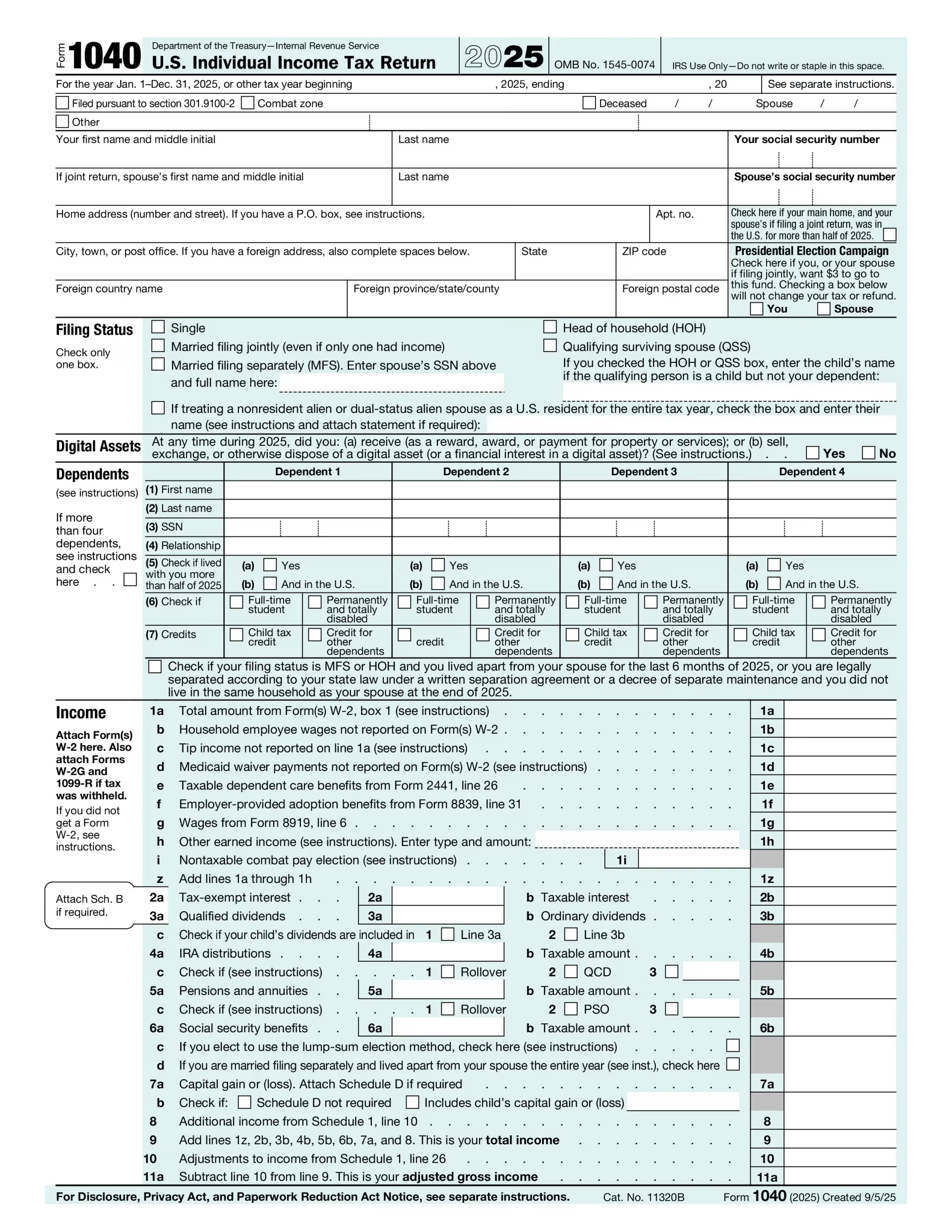

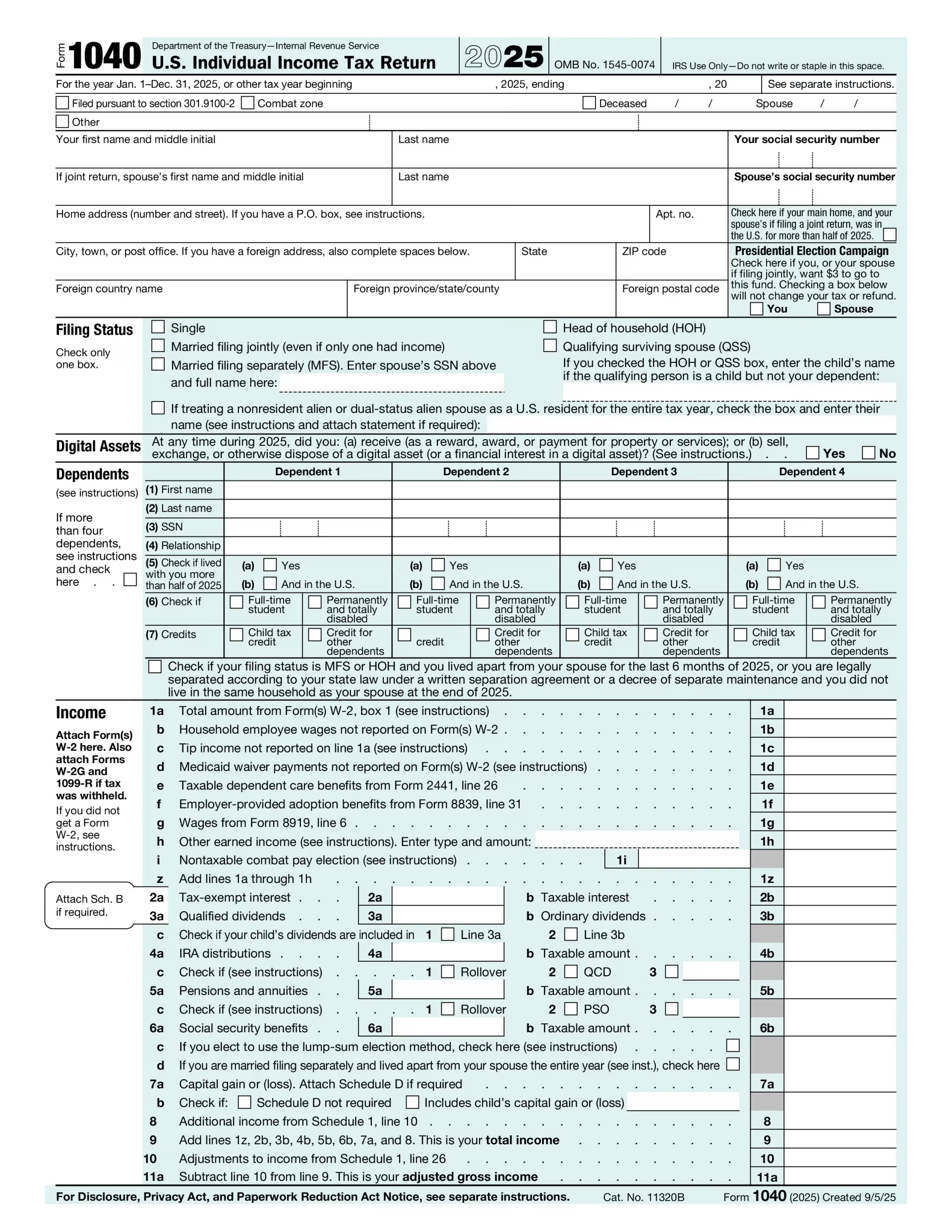

What is a 1040 Form?

The 1040 tax form is the primary document filed with the IRS annually. Taxpayers use this form to report their annual income, calculate taxable income after claiming adjustments and deductions, apply tax credits, and determine the final amount of tax owed or refund due.

Who needs to file a 1040 Form?

Most U.S. citizens and residents who earn income are required to file Form 1040. This includes employees, self-employed individuals, retirees, and investors.

Why is Form 1040 important?

What information is included in Form 1040?

When is the 1040 Form due?

Get Your 1040 Fillable Form Online

The Zendocs platform simplifies completing your Form 1040 for both 2025 & 2026 tax years:

Gyakran ismételt kérdések

1. Töltse ki az űrlapot

Töltse ki adatait és információit, adjon hozzá dátumot és szabja testre szükség szerint

2. Adja hozzá aláírását

Adjon hozzá jogilag kötelező aláírást rajzolással, feltöltéssel vagy gépelésssel

3. Töltse le vagy ossza meg

Az űrlap kész, töltse le, ossza meg a linket vagy küldje el emailben azonnal