Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

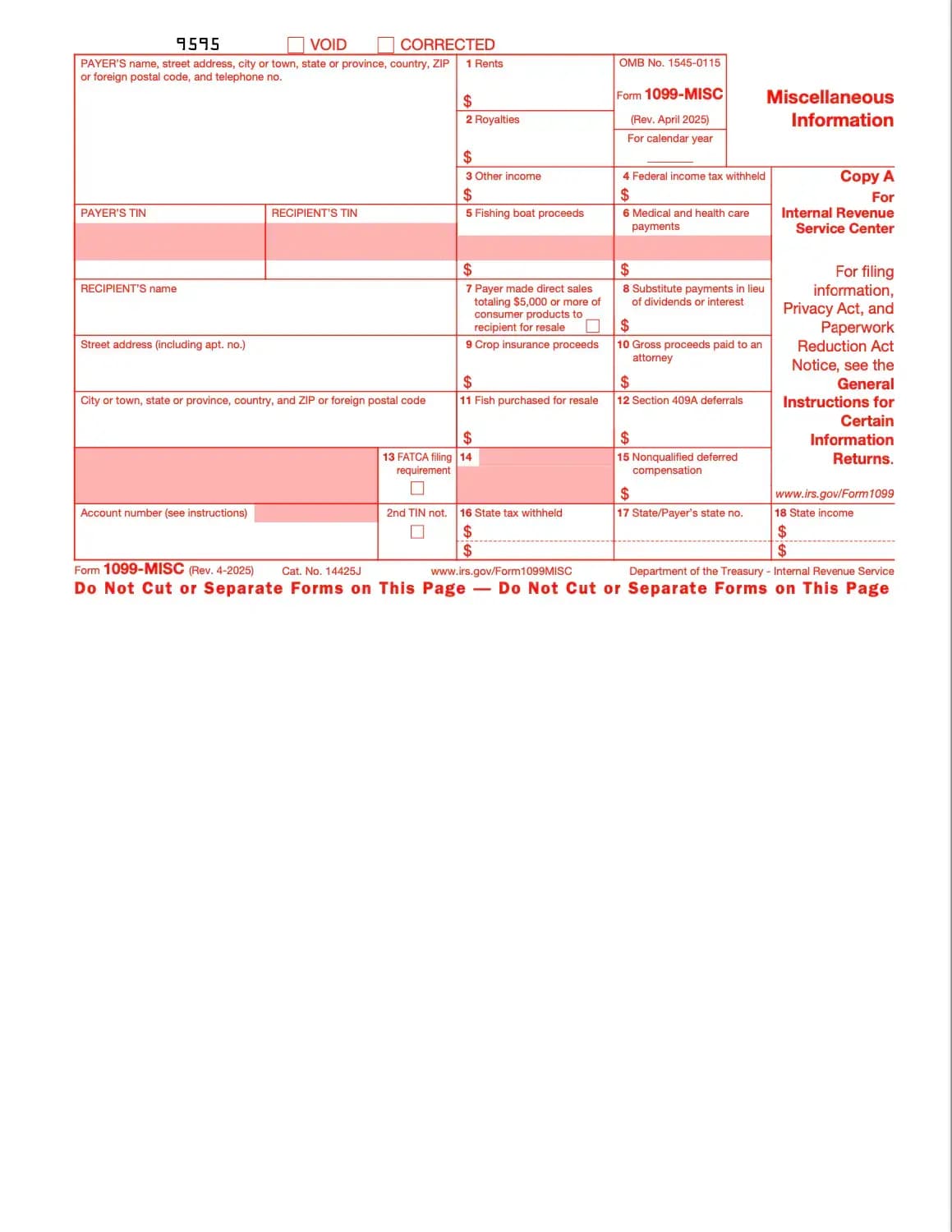

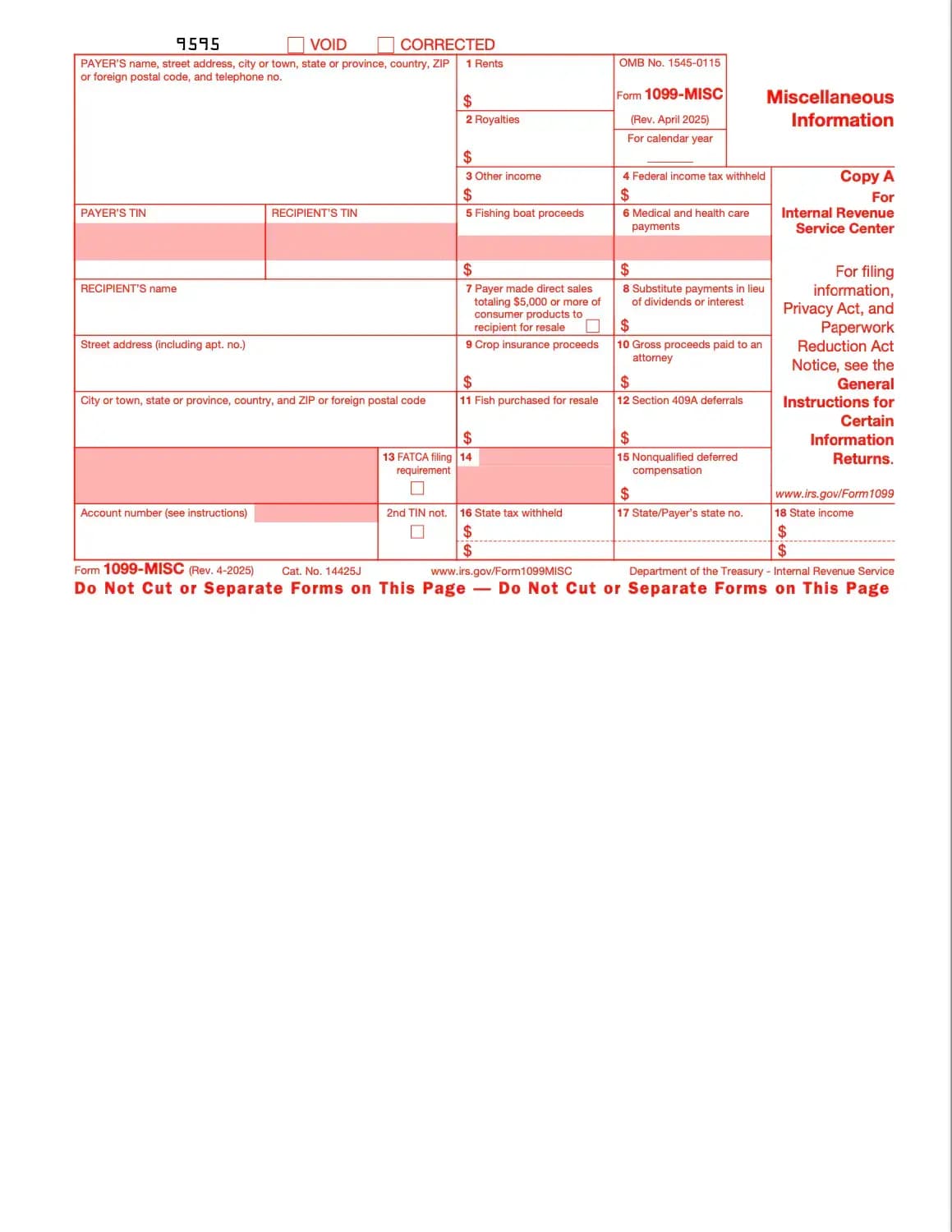

What is Form 1099-MISC?

The IRS 1099-MISC form is used to report miscellaneous income that doesn’t fall under regular wages or self-employment pay. It covers rent payments, royalties, prizes, awards, medical and healthcare payments, and other income categories.

Why is it important?

The IRS requires accurate reporting of all income. Recipients of 1099-MISC must include the amounts on their tax returns. Failing to report this income can result in penalties and interest.

Who must file Form 1099-MISC?

Businesses or individuals who paid:

What’s the difference between 1099-MISC and 1099-NEC?

What information is included?

When is it due?

Mistoqsijiet ta’ spiss

1. Imla l-Formola

Imla d-dettalji u l-informazzjoni tiegħek, żid data u personalizza kif meħtieġ

2. Żid il-Firma Tiegħek

Żid firma legalment vinkolanti billi tiddisinja, ittella', jew tittajpja

3. Niżżel jew aqsam

Il-formola tiegħek lesta, niżżel, aqsam link jew ibgħat permezz ta' email immedjatament