Zendocs is not affiliated with the IRS.

Zendocs is not affiliated with the IRS.

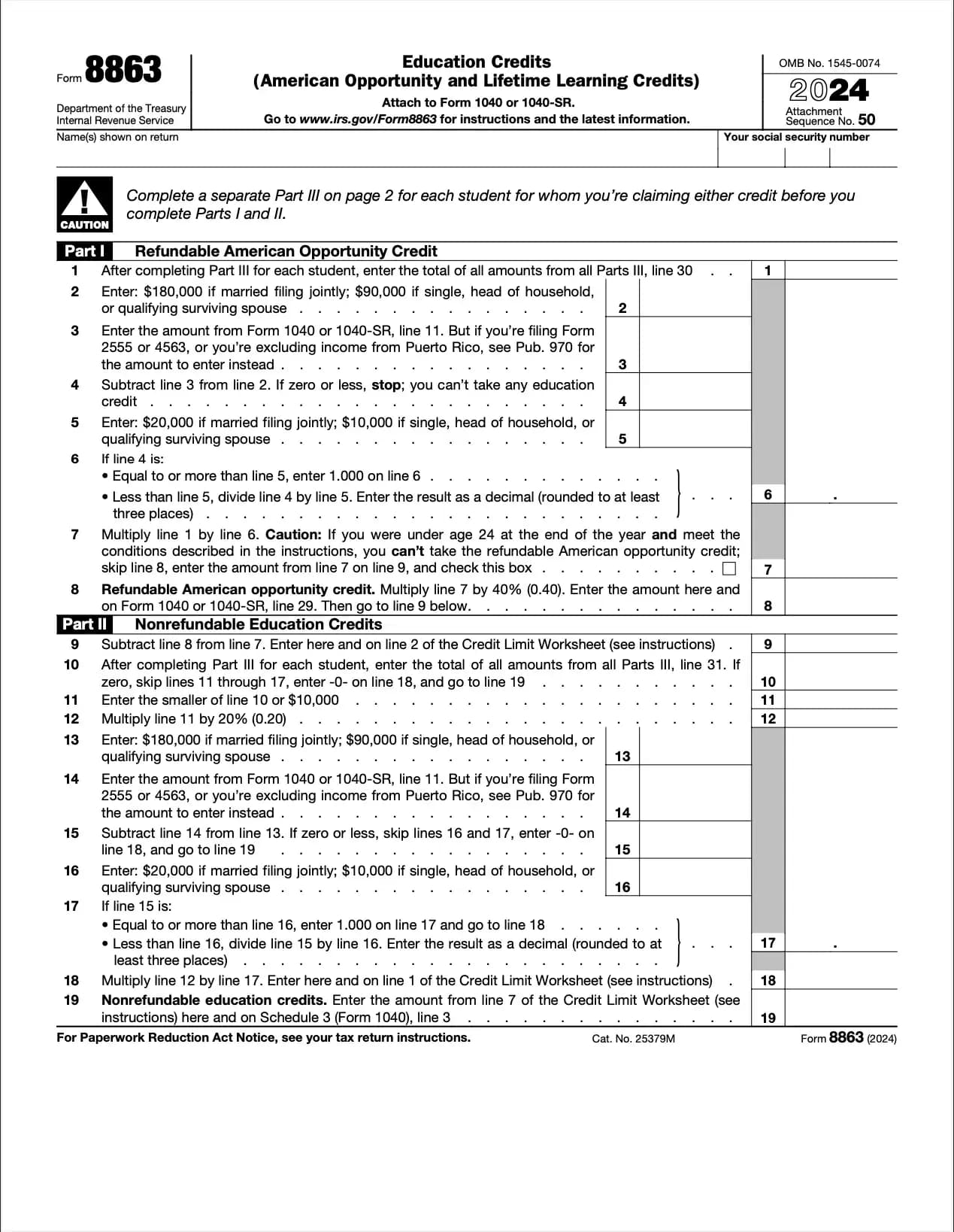

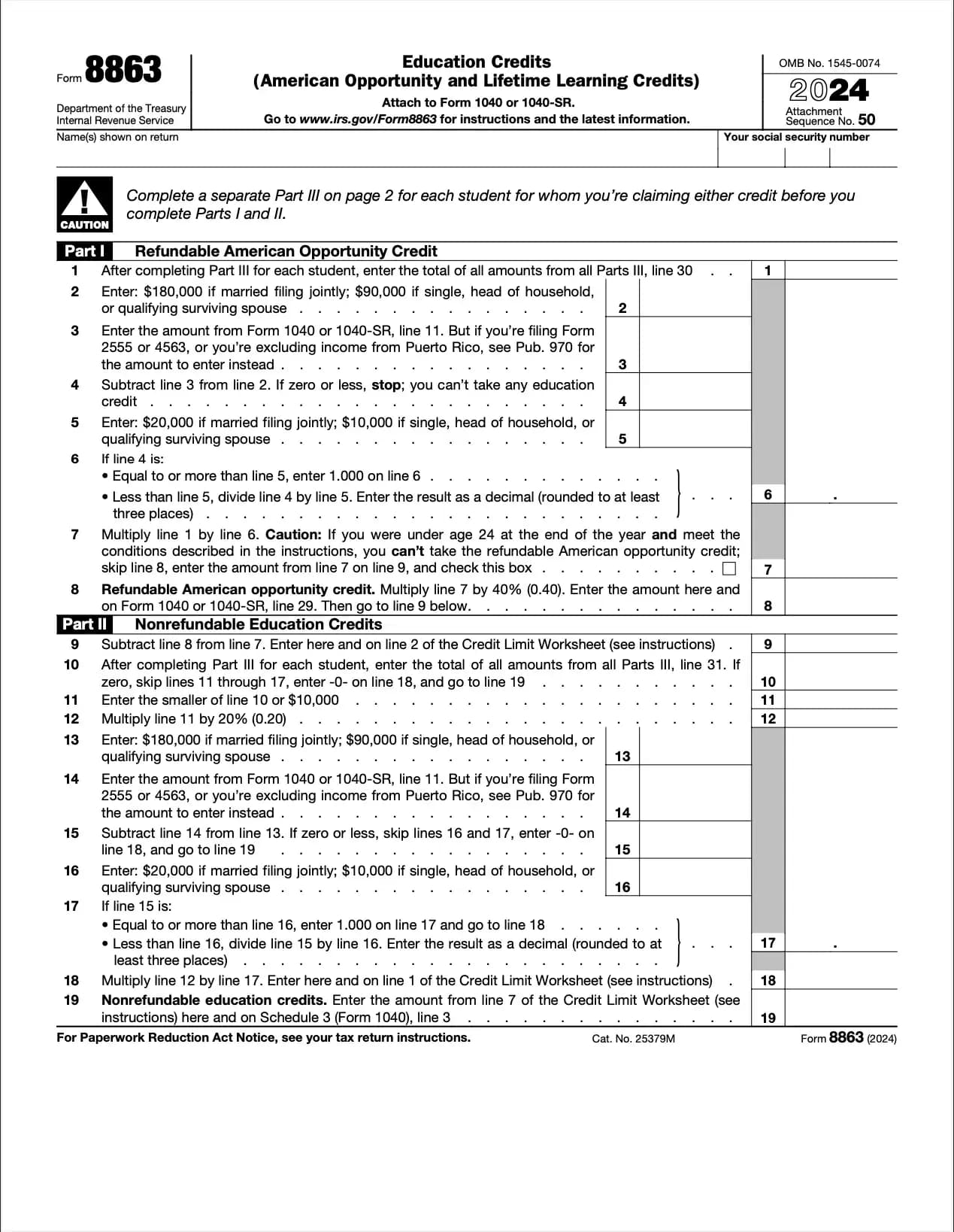

What is Form 8863?

Form 8863 lets taxpayers claim education-related credits that lower their tax liability. Unlike deductions, these credits directly reduce the tax you owe — and in the case of the AOTC, may even result in a refund.

Types of Education Credits on Form 8863

Who Can File Form 8863?

Key Information Needed

When is it due?

Why is it important?

These credits help offset the rising cost of higher education. Claiming them can save thousands of dollars in taxes and free up more funds for tuition, living expenses, or future savings.

Často kladené otázky

1. Vyplňte formulár

Vyplňte vaše údaje a informácie, pridajte dátum a prispôsobte podľa potreby

2. Pridajte váš podpis

Pridajte právne záväzný podpis kreslením, nahratím alebo písaním

3. Stiahnite alebo zdieľajte

Váš formulár je pripravený, stiahnite, zdieľajte odkaz alebo pošlite emailom okamžite