Zendocs is not affiliated with the Internal Revenue Service (IRS).

Zendocs is not affiliated with the Internal Revenue Service (IRS).

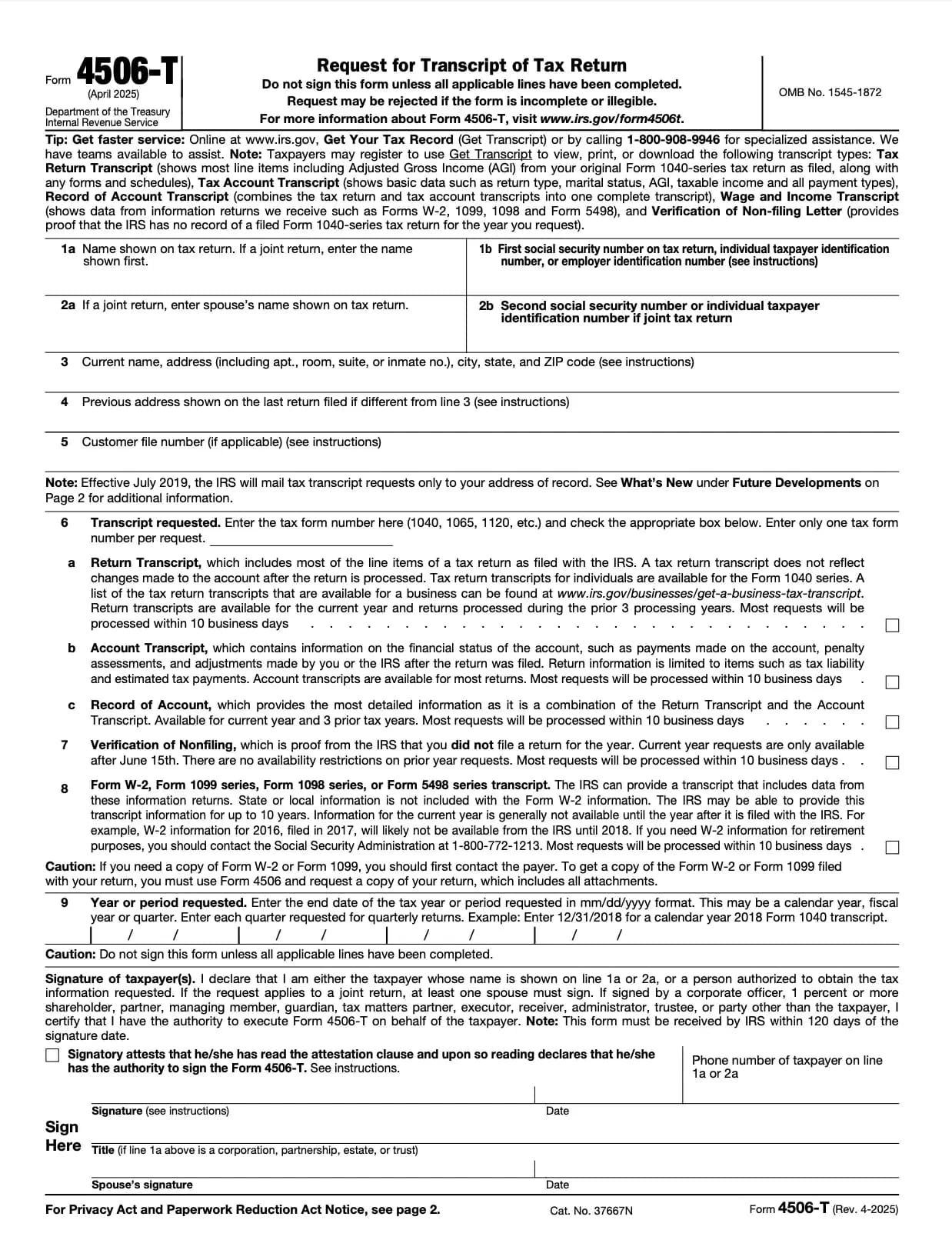

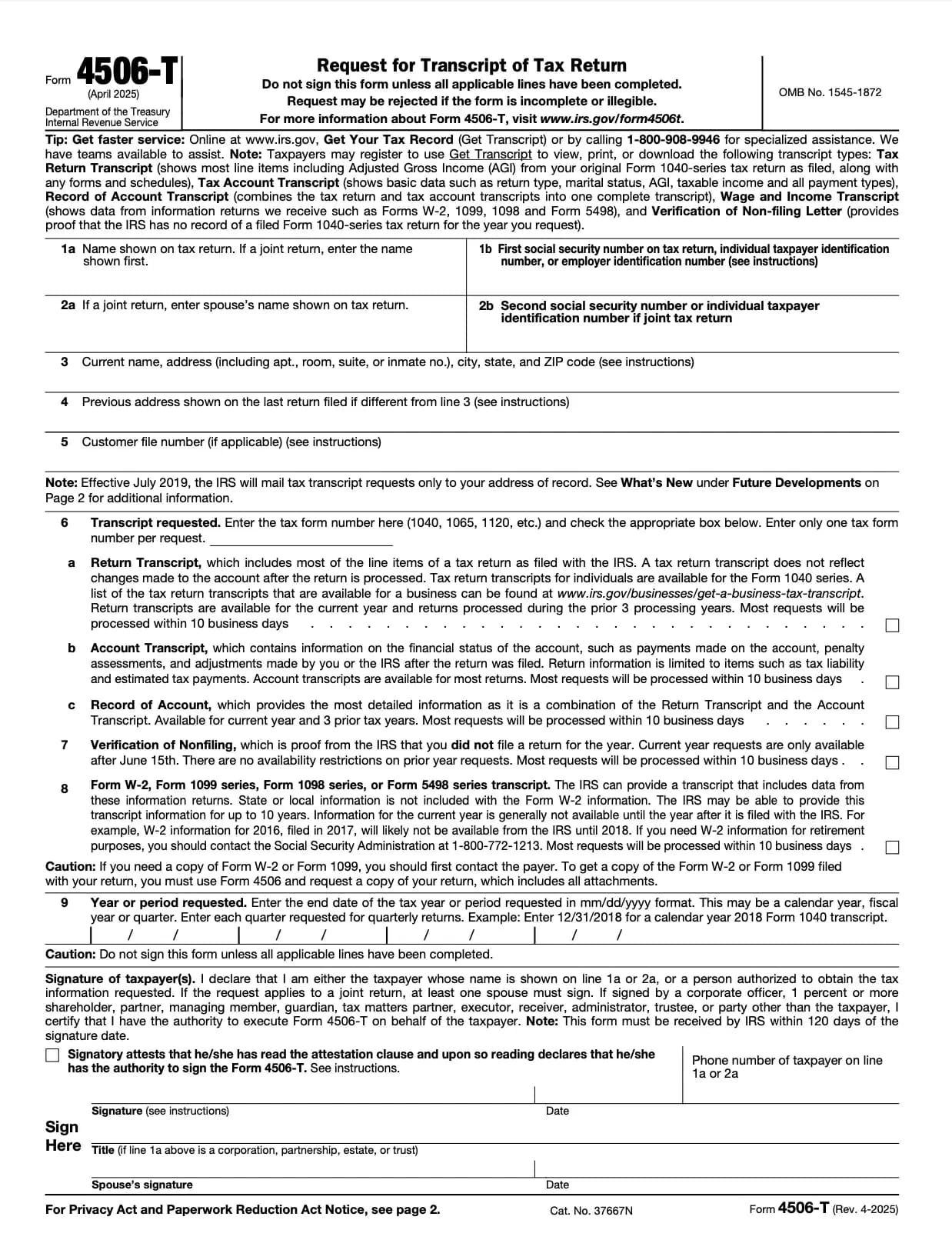

Form 4506-T (Request for Transcript of Tax Return) is a simple way to access IRS-issued summaries of previously filed returns. The form provides line-by-line data, including income, deductions, and tax payments, which can be used for verification or documentation.

The IRS typically processes Form 4506-T within 5-10 business days. Transcripts are mailed to the taxpayer or directly to the third party authorized on the form.

คำถามที่พบบ่อย

1. กรอกแบบฟอร์ม

กรอกรายละเอียดและข้อมูลของคุณ เพิ่มวันที่และปรับแต่งตามต้องการ

2. เพิ่มลายเซ็นของคุณ

เพิ่มลายเซ็นที่มีผลผูกพันทางกฎหมายโดยการวาด อัปโหลด หรือพิมพ์

3. ดาวน์โหลดหรือแบ่งปัน

แบบฟอร์มของคุณพร้อมแล้ว ดาวน์โหลด แบ่งปันลิงก์ หรือส่งทางอีเมลทันที